Unusual Options Activity: Daqo New Energy Corp (DQ)

Shares of Chinese semiconductor company

Daqo New Energy Corp (DQ) are down nearly 40 percent in the past year. One trader sees a potential rebound ahead. That’s based on the December 16th $50 calls. With 44 days until expiration, 2,849 contracts traded compared to a prior open interest of 113, for a 25-fold rise in volume on the trade. The buyer of the calls paid $2.28 to get in. Shares recently traded for about $44, so they’d need to rise $6, or about ...

Read More About This

Daqo New Energy Corp (DQ) are down nearly 40 percent in the past year. One trader sees a potential rebound ahead. That’s based on the December 16th $50 calls. With 44 days until expiration, 2,849 contracts traded compared to a prior open interest of 113, for a 25-fold rise in volume on the trade. The buyer of the calls paid $2.28 to get in. Shares recently traded for about $44, so they’d need to rise $6, or about ...

Read More About This

Buy Volatile Stocks When They Take a Dive

Some stocks deliver slow and steady returns over time that can compound out into a phenomenal profit. Others can be volatile – but that volatility allows investors to earn even more over time, provided they don’t get scared out of a trade.

Right now, a number of companies have been taking big hits following earnings. And while it’s scary, separating the companies likely to best rebound from this slowing economy will lead to big returns.

Case in point?

Amazon (AMZN). The retailing giant ...

Read More About This

Amazon (AMZN). The retailing giant ...

Read More About This

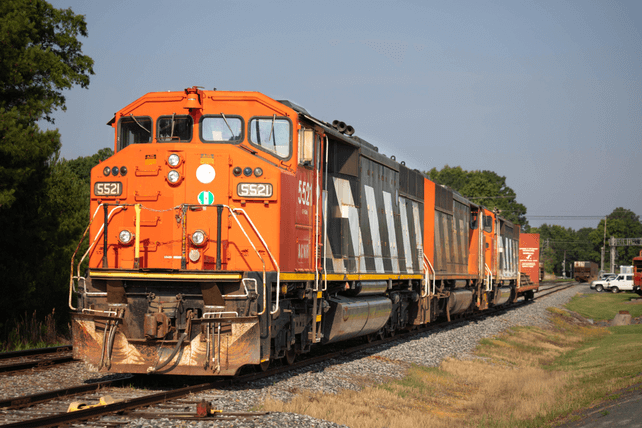

Insider Trading Report: Union Pacific Corp (UNP)

Teresa Finley, a director at

Union Pacific Corp (UNP), recently added 1,380 shares. The buy represents an initial stake for the director, who paid just under $260,000 for the position. This represents the first insider buy at the railroad since early 2020. Company insiders have been occasional sellers of shares over the past three years, with directors more likely to be buyers following a dip in price. Overall, insiders own 0.3 percent of shares. The railroad has dropped about 19 percent in the ...

Read More About This

Union Pacific Corp (UNP), recently added 1,380 shares. The buy represents an initial stake for the director, who paid just under $260,000 for the position. This represents the first insider buy at the railroad since early 2020. Company insiders have been occasional sellers of shares over the past three years, with directors more likely to be buyers following a dip in price. Overall, insiders own 0.3 percent of shares. The railroad has dropped about 19 percent in the ...

Read More About This

Unusual Options Activity: Star Bulk Carriers (SBLK)

Shares of marine shipping company

Star Bulk Carriers (SBLK) are down about 14 percent in the past year, as shipping rates have started to come off extreme highs. One trader sees an even bigger drop for shares ahead. That’s based on the December 16th $16 puts. With 45 days until expiration, 6,761 contracts traded compared to a prior open interest of 102, for a 66-fold rise in volume on the trade. The buyer of the puts paid $1.60. Shares recently went for ...

Read More About This

Star Bulk Carriers (SBLK) are down about 14 percent in the past year, as shipping rates have started to come off extreme highs. One trader sees an even bigger drop for shares ahead. That’s based on the December 16th $16 puts. With 45 days until expiration, 6,761 contracts traded compared to a prior open interest of 102, for a 66-fold rise in volume on the trade. The buyer of the puts paid $1.60. Shares recently went for ...

Read More About This

Pick Up This Financial Leader Amid the Latest Market Fear

Sectors tend to start out with an explosion of activity, then consolidate into a few big names over time. That’s played out in everything from automakers to the media. As this happens, surviving companies tend to settle into making steady profits.

And when there are just a handful of players, one will typically stand out as the industry leader. This company will fare slightly better than its peers for various reasons.

One consolidated sector worth buying for the long term is the ...

Read More About This

Read More About This

Insider Trading Report: Riley Exploration Permian (REPX)

Alvin Libin, a major owner at

Riley Exploration Permian (REPX), recently added 23,755 shares. The buy increased his stake by 1.2 percent, and came to a total cost just over $641,000. That’s just one of five buys made by the insider in the past few weeks. Other buys have been in the 5,377 to 9,593 share range. In total, this insider has bought over $1.2 million in shares in the past few weeks. In the past three years, insider buying has handily ...

Read More About This

Riley Exploration Permian (REPX), recently added 23,755 shares. The buy increased his stake by 1.2 percent, and came to a total cost just over $641,000. That’s just one of five buys made by the insider in the past few weeks. Other buys have been in the 5,377 to 9,593 share range. In total, this insider has bought over $1.2 million in shares in the past few weeks. In the past three years, insider buying has handily ...

Read More About This

Unusual Options Activity: Cleveland-Cliffs Inc (CLF)

Shares of iron ore producer

Cleveland-Cliffs (CLF) have lost 40 percent of their value in the past year, more than double the drop in the S&P 500. One trader sees a further decline ahead. That’s based on the March 2023 $9 puts. With 137 days until expiration, 6,374 contracts traded compared to a prior open interest of 117, for a 54-fold rise in trading volume. The buyer of the puts paid $0.41 to get in. Shares recently traded near $14, so the ...

Read More About This

Cleveland-Cliffs (CLF) have lost 40 percent of their value in the past year, more than double the drop in the S&P 500. One trader sees a further decline ahead. That’s based on the March 2023 $9 puts. With 137 days until expiration, 6,374 contracts traded compared to a prior open interest of 117, for a 54-fold rise in trading volume. The buyer of the puts paid $0.41 to get in. Shares recently traded near $14, so the ...

Read More About This

Buy Strong Brands Being Hit by the Stronger Dollar

One trend this earnings season has been a number of companies impacted by the strength of the US dollar in currency markets. As a result, multinational companies are reporting headwinds, as a strong dollar makes them relatively more expensive in local markets.

That trend will end in time, and may even shift quickly once monetary policy stops tightening. As the trend reverses, companies that have been adversely impacted will suddenly benefit.

Among multinational companies holding up strong right now is

Mondelez International (MDLZ) ...

Read More About This

Mondelez International (MDLZ) ...

Read More About This