Insider Trading Report: Sealed Air Corp (SEE)

Sergio Pupkin, a senior vice president atSealed Air Corp (SEE), recently picked up 1,000 shares. The buy increased his holdings by 2 percent, and came to a total cost of just over $44,000.

He was joined by a director making a first-time buy of 1,200 shares, paying out about $50,000 for the stake. This marks the first insider activity at the company since November 2020. Over the past three years, insider buys have beaten out total insider sales.

Overall, company insiders own ...

Read More About This

Read More About This

Insider Trading Report: Newell Brands (NWL)

James Craigie, a director atNewell Brands (NWL), recently bought 10,000 shares. The buy increased his holdings by nearly 46 percent, and came to a total cost of just over $133,000.

This marks the first insider buy at the company since mid-2021. Company directors have been sellers of shares this year until this latest buy. Over the past three years, insider buying has far exceeded insider selling.

Overall, company insiders own 0.5 percent of shares.

Shares of the home goods manufacturer are down 47 ...

Read More About This

Read More About This

Insider Trading Report: Barnes Group (B)

Richard Hipple, a director atBarnes Group (B), recently bought 1,200 shares. The buy increased his holdings by nearly 9 percent, and came to a total cost just under $43,000.

That’s the first insider buy at the company in over two months. Another director has been buying this year, and some company insiders have been sellers. Over the past year, buys have exceeded sales. However, large insider sales in 2020 tip the scale over the past three years to sellers.

Overall, company insiders ...

Read More About This

Read More About This

Insider Trading Report: Farmers National Bank (FMNB)

Anne Crawford, a director atFarmers National Bank (FMNB), recently picked up 1,500 shares. The buy increased her holdings by 1.7 percent, and came to a total cost of just under $21,000.

This is the first insider buy since August. Company directors have been active buyers all year, mostly for trades in the $20-25,000 range. Company executives were also buyers earlier in the year. There have only been a handful of insider sales over the past three years.

Overall, company insiders own 8.4 ...

Read More About This

Read More About This

Insider Trading Report: Allegion PLC (ALLE)

John Stone, President and CEO atAllegion PLC (ALLE), recently picked up 12,500 shares. The buy increased his holdings by 24 percent, and came to a total cost just over $1.03 million.

This marks the first insider buy at the company in over three years. Otherwise, company insiders, nearly all executives, have been sellers of shares over the past three years. That includes sales from the former company President and CEO.

Overall, company executives own 0.5 percent of shares.

Shares of the lock manufacturer ...

Read More About This

Read More About This

Insider Trading Report: Beacon Roofing Supply (BECN)

CD&R Investment Associates, a major holder ofBeacon Roofing Supply (BECN), recently added another 105,320 shares. The buy increased the fund’s stake by 0.7 percent, and came to a total cost of just over $6 million.

Over the past three years, there’s been a mix of insider buys and sells. Insider sales are slightly higher overall, thanks to some large sales in early 2021. More recently, insider activity has been evenly mixed.

Corporate insiders own about 0.5 percent of shares, while institutions like ...

Read More About This

Read More About This

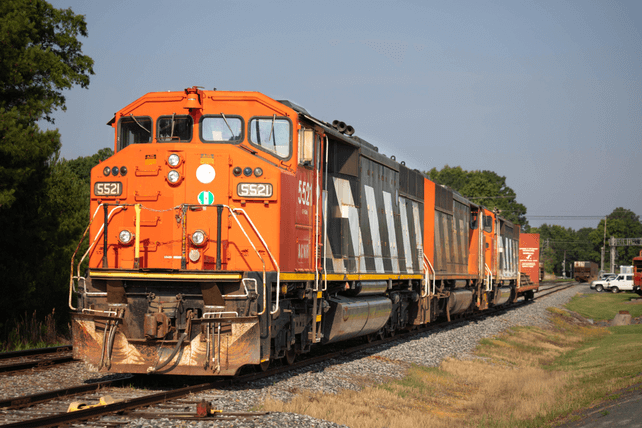

Insider Trading Report: Union Pacific Corp (UNP)

Teresa Finley, a director atUnion Pacific Corp (UNP), recently added 1,380 shares. The buy represents an initial stake for the director, who paid just under $260,000 for the position.

This represents the first insider buy at the railroad since early 2020. Company insiders have been occasional sellers of shares over the past three years, with directors more likely to be buyers following a dip in price.

Overall, insiders own 0.3 percent of shares.

The railroad has dropped about 19 percent in the past ...

Read More About This

Read More About This

Insider Trading Report: Riley Exploration Permian (REPX)

Alvin Libin, a major owner atRiley Exploration Permian (REPX), recently added 23,755 shares. The buy increased his stake by 1.2 percent, and came to a total cost just over $641,000.

That’s just one of five buys made by the insider in the past few weeks. Other buys have been in the 5,377 to 9,593 share range. In total, this insider has bought over $1.2 million in shares in the past few weeks. In the past three years, insider buying has handily ...

Read More About This

Read More About This