Declining Uncertainty Is Good for Stock Prices

Investors don’t like uncertainty. That tends to lead prices lower, which can create a good buying opportunity. Ideally, the time to buy is when uncertainties that represent a major threat to a business start to go fade away. That may not mean an immediate move higher, but it will likely mean the end of a downtrend and an opportunity to beat the market over time. Among company-specific uncertainties, one of the most challenging to contend with is litigation. When a company is ...

Read More About This

Read More About This

For Big Trend Profits, Follow the Money

Investors often follow big trends. And by investing in those trends when they’re out of favor, they stand to make a fortune. That’s especially true when the big trend involves support from the government, whether in the form of tax credits, direct payments, or loans. For instance,Tesla Motors (TSLA) grew in part due to tax incentives for buyers of electric vehicles. That benefit still exists today, giving EV buyers a potential $7,500 advantage over buying a traditional gas vehicle. Other automakers are ...

Read More About This

Read More About This

Invest In the Next Generation App Technology

One of the biggest trends of the past 15 years has been the growth of apps, particularly smartphone apps. However, investing in that trend has been a challenge. Outside of owning a smartphone manufacturer or developer likeApple (AAPL), there hasn’t been one specific way to play that trend. For the next generation of apps, led by AI technologies, there are now several opportunities emerging. Many are from deep-pocketed companies that already provide back-end software services. For instance,Adobe (ADBE) is best known for ...

Read More About This

Read More About This

Keep Investing with the Strategy that Moves Stock Prices Higher

There are many ways for a company to deliver value to shareholders. Once a company reaches a certain size, growth becomes more difficult without coming up with new and potentially expensive initiatives. That’s why many large companies start paying a dividend. Companies have another trick up their sleeve too. That trick is the share buyback program. As long as a company isn’t using debt to retire shares, it can have a great long-term impact on prices. Payment processing companyPayPal Holdings (PYPL) is ...

Read More About This

Read More About This

Look for Pullback Plays in AI Stocks

It’s likely that the AI trend has staying power. But many AI stocks have gone nearly vertical in recent weeks. That suggests the space is ripe for a pullback that could bring down valuations quickly, and set up a further run later in the year. Such a move already occurred after a short rally in AI stocks to start the year. Now, investors have more companies working on AI initiatives to invest in, which creates a better watch list of opportunities. One ...

Read More About This

Read More About This

Buy When the Bad News Piles In

Sometimes, it seems like a company can do no wrong. That’s when it’s a dangerous time to invest. That’s because good news pushes prices higher. But once buyers are exhausted, even more good news is unlikely to move prices higher. The reverse also holds true. When a company has had a series of poor earnings reports or other bad news, one more event likely won’t move things too much lower. Entertainment giantThe Walt Disney Company (DIS) has been hit with a lot ...

Read More About This

Read More About This

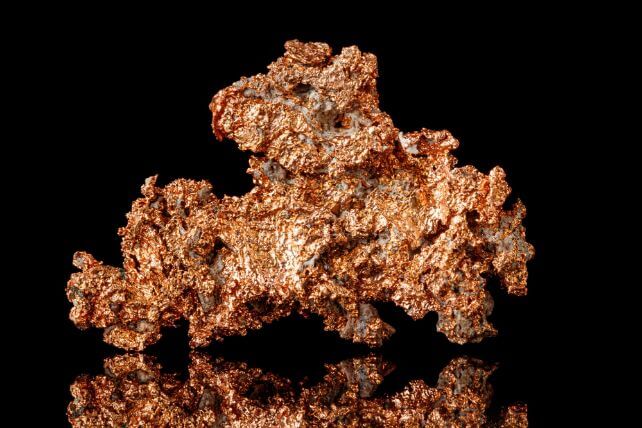

This Commodity Is Heading for an Upswing – Buy the Industry Leader

Traders are starting to bet more on a soft landing for the economy, rather than a heavy recession. That’s good news. It also means that some sectors should perform better than expected in the months ahead. One area is construction. From increased infrastructure spending to a housing boom, there are plenty of ways to play the trend. The top way is to invest in commodities that rise in response to a strong economy. The key commodity is copper. The metal’s relatively low ...

Read More About This

Read More About This

When Stocks Get Exciting, Look the “Least Exciting” Opportunity

With tech stocks largely back in fashion, there are a few laggards out there. They may be the better opportunity going forward. That’s because laggards have better valuations, having not run up as much. And they may surprise investors with strong operational performance. That’s especially true when contrasting some of the biggest players year-to-date, and especially where investors aren’t that excited for a specific company at the moment. Investors don’t need to find the most boring stock, just one that’s less ...

Read More About This

Read More About This