Unusual Options Activity: Macy’s (M)

Department store chain

Macy’s (M) has traded flat over the past year, as the company has been targeted for a buyout, but rejected that offer. One trader sees shares trending lower into next year. That’s based on the February 2025 $15 puts. With 205 days until expiration, 3,325 contracts traded compared to a prior open interest of 114, for a 29-fold rise in volume on the trade. The buyer of the puts paid $1.22 to make the bearish bet. Macy’s recently traded for ...

Read More About This

Macy’s (M) has traded flat over the past year, as the company has been targeted for a buyout, but rejected that offer. One trader sees shares trending lower into next year. That’s based on the February 2025 $15 puts. With 205 days until expiration, 3,325 contracts traded compared to a prior open interest of 114, for a 29-fold rise in volume on the trade. The buyer of the puts paid $1.22 to make the bearish bet. Macy’s recently traded for ...

Read More About This

Unusual Options Activity: Pfizer (PFE)

Drug manufacturer Pfizer (PFE) is down 16% over the past year, but shares have been in an uptrend since April. One trader sees shares trending higher through next spring.

That’s based on the March 2025 $34 calls. With 234 days until expiration, 9,332 contracts traded compared to a prior open interest of 252, for a 37-fold rise in volume on the trade. The buyer of the calls paid $1.48 to make the bullish bet.

Pfizer shares recently traded for just under $31, ...

Read More About This

Read More About This

Unusual Options Activity: AST SpaceMobile (ASTS)

Space-based cellular broadband network AST SpaceMobile (ASTS) is up 240% over the past year. One trader is betting that shares will continue higher through the end of summer.

That’s based on the September 20 $22.50 calls. With 52 days until expiration, 6,160 contracts traded compared to a prior open interest of 103, for a 60-fold rise in volume on the trade. The buyer of the calls paid $1.40 to make the bullish bet.

ASTS shares recently traded for about $16.50, right ...

Read More About This

Read More About This

Unusual Options Activity: V.F. Corporation (VFC)

Apparel manufacturer V.F. Corporation (VFC) is down 17% over the past year and trending lower. One trader sees a further decline in the weeks ahead.

That’s based on the August $15.50 puts. With 21 days until expiration, 5,237 contracts traded compared to a prior open interest of 163, for a 32-fold rise in volume on the trade. The buyer of the puts paid $0.89 to make the bearish bet.

VFC shares recently traded for about $16, making this an at-the-money trade. Shares ...

Read More About This

Read More About This

Unusual Options Activity: GE Aerospace (GE)

Aerospace and airplane component manufacturer GE Aerospace (GE) is up over 70% in the past year. One trader sees further gains in the weeks ahead.

That’s based on the August 16 $200 calls. With 22 days until expiration, 10,2298 contacts traded compared to a prior open interest of 107, for a 96-fold rise in volume on the trade. The buyer of the calls paid $0.31 to make the bullish bet.

GE Aerospace shares recently traded for about $174, meaning the stock would ...

Read More About This

Read More About This

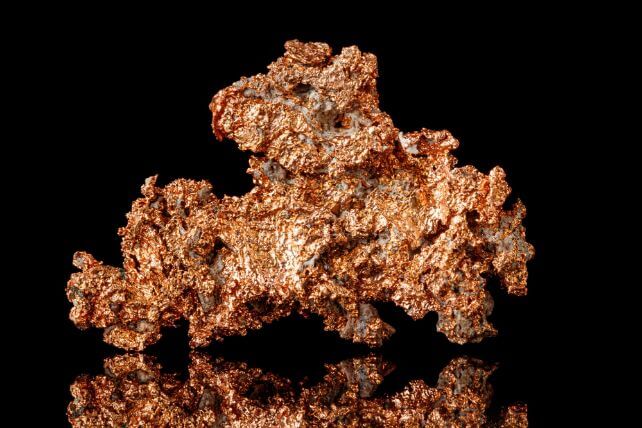

Unusual Options Activity: Freeport-McMoRan (FCX)

Copper producer

Freeport-McMoRan (FCX), is up 9% over the past year, slightly lagging the overall market. One trader sees shares trending higher into the autumn. That’s based on the October 18 $55 calls. With 86 days until expiration, 5,020 contracts traded compared to a prior open interest of 182, for a 28-fold rise in volume on the trade. The buyer of the calls paid $0.82 to make the bullish bet. Freeport shares recently traded for about $46, so they would need to rise ...

Read More About This

Freeport-McMoRan (FCX), is up 9% over the past year, slightly lagging the overall market. One trader sees shares trending higher into the autumn. That’s based on the October 18 $55 calls. With 86 days until expiration, 5,020 contracts traded compared to a prior open interest of 182, for a 28-fold rise in volume on the trade. The buyer of the calls paid $0.82 to make the bullish bet. Freeport shares recently traded for about $46, so they would need to rise ...

Read More About This

Unusual Options Activity: Carvana (CVNA)

Online car dealership Carvana (CVNA) is up 183% over the past year, soaring well beyond the overall stock market’s return. One trader sees a pullback in the second half of the year.

That’s based on the January 2025 $115 puts. With 178 days until expiration, 19,001 contracts traded compared to a prior open interest of 288, for a 66-fold rise in volume on the trade. The buyer of the puts paid $18.70 to make the bearish bet.

Carvana shares recently traded for ...

Read More About This

Read More About This

Unusual Options Activity: Patterson-UTI Energy (PTEN)

Oil and gas drilling services provider Patterson-UTI Energy (PTEN) is down 25% over the past year. One trader sees shares declining over the coming weeks.

That’s based on the August 16 $10 puts. With 25 days until expiration, 48,155 contracts traded compared to a prior open interest of 711, for a 68-fold rise in volume on the trade. The buyer of the puts paid $0.20 to make the bearish bet.

Patterson-UTI Energy shares recently traded for about $10.75, so they would need ...

Read More About This

Read More About This