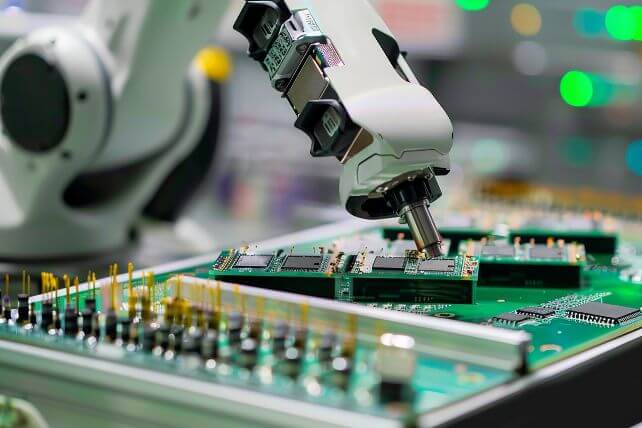

Insider Activity Report: Applied Materials (AMAT)

Gary Dickerson, President and CEO of Applied Materials (AMAT), recently bought 50,000 shares. The buy increased his position by 3%, and came to a total cost of $6.85 million. This marks the first insider buy at the company over the past two years. Otherwise, insiders have been periodic sellers of shares over the past two years. That includes Dickerson, who sold 400,000 shares last June, at a share price over $100 higher from where AMAT trades today. Overall, Applied Materials insiders ...

Read More About This

Read More About This

Unusual Options Activity: Antero Resources (AR)

Oil and gas exploration company Antero Resources (AR) is up 13% over the past year, bucking the energy sector’s decline as a whole. However, amid the tariff uncertainty, one trader sees further downside in the weeks ahead. That’s based on the May $25 puts. 21,670 contracts recently traded compared to a prior open interest of 123 contracts, for a massive 176-fold rise in volume on the trade. The options have 36 days left until expiration, and recently traded for about $0.80. Antero ...

Read More About This

Read More About This

Government Spending Cuts Are Unlikely to Slow This Defense Company’s Growth

As the Trump administration looks to find ways to cut back America’s $2+ trillion national debt, investors are eyeing companies with large government contracts. Staffing companies have already fallen on the logic that temporary workers for government agencies are out. But now the trend is widening. It’s also hitting defense contractors, as cutting defense spending could be a key way to bridge the budget gap. However, investors may have an opportunity in today’s markets. That’s because data-related spending is likely to continue ...

Read More About This

Read More About This

Insider Activity Report: Salesforce (CRM)

Oscar Munoz, a director at Salesforce (CRM), recently bought 3,882 shares. The buy increased his stake by 49%, and came to a total cost of $998,773. This is the second insider buy at Salesforce this year, following another director buy of 1,695 shares in February, at a cost of $499,355. Otherwise, company insiders have been regular sellers of shares, largely following the exercise of stock options. Notable sales include the company CFO and a company Co-Founder. Overall, Salesforce insiders own 2.6% ...

Read More About This

Read More About This

Unusual Options Activity: Dow Inc. (DOW)

Chemical manufacturer Dow Inc. (DOW) is down over 50% in the past year. One trader is betting on a rebound by the end of 2025. That’s based on the January 2026 $25 calls. The option has 282 days until expiration, and just saw a 31-fold rise in trading volume from 100 contracts to 3,067. The buyer of the calls paid $5.13 to make the bullish bet. Dow recently traded for about $27, making the trade about $2.00 in-the-money. Shares recently fell with ...

Read More About This

Read More About This

Tariff Fears Are Putting These High-Profit-Margin Stocks on Sale

Nearly every market sector has been hit hard in the past week amid rising global tariffs and retaliatory measures. However, all sectors are different, and some of today’s selloff could be overdone. Even if the tariff situation gets worse before it gets better, some companies could actually benefit from the rising fears right now. That includes wealth management companies, who have no product that could be impacted by tariffs, and whose services are needed as much as eve For instance, The Charles ...

Read More About This

Read More About This

Insider Activity Report: Dollar Tree (DLTR)

William Douglas, a director at Dollar Tree (DLTR), recently bought 7,500 shares. The buy increased his stake by over 1,000%, and came to total cost of $520,000. This marks the first insider buy since last September, when another company director bought 2,200 shares for just over $150,000. In the meantime, there have been two small insider sales, including a $31,000 sale from the company CEO for less than 1% of his holdings. Overall, Dollar Tree insiders own 0.1% of shares. The dollar ...

Read More About This

Read More About This

Unusual Options Activity: Blue Owl Capital (OWL)

Asset manager Blue Owl Capital (OWL) is down 7% over the past year, with share sinking with the overall market. One trader is betting on a further move lower in the coming weeks. That’s based on the May 2025 $16 puts. 15,051 contracts recently traded hands, a massive 87-fold rise over the prior open interest of 172 contracts. The option has 38 days until expiration, and the buyer of the puts paid $1.70 to make the bearish bet. Blue Owl shares recently ...

Read More About This

Read More About This