A Recession-Resistant Play Worth Accumulating Now

Markets are pricing in a higher chance of a recession. That’s led to fast deleveraging by hedge funds, sending the market into a tailspin. But some companies are more recession-resistant than others. Investors can hold up during a fearful market with more recession-resistant companies. That includes goods and services that have strong demand, no matter what the economy is doing. Investors who buy these companies during periods of fears can earn reasonable returns while the economy sorts itself out. For instance, plumbing-equipment ...

Read More About This

Read More About This

Insider Activity Report: Sempra (SRE)

Richard Mark, a director at Sempra (SRE), recently bought 7,160 shares. The buy increased his stake by a massive 130%, and came to a total cost of $499,840. Two other company directors also bought shares around the same time, albeit for 1,000 and 700 shares, or about $68,000 and $50,000. Those mark the first insider buys since last May. Otherwise, there have been a few insider sales, including over $4 million in sales from the company’s CEO. Overall, Sempra insiders own ...

Read More About This

Read More About This

Unusual Options Activity: Alcoa Corporation (AA)

Aluminum producer Alcoa Corporation (AA) is up 11% over the past year but has had some big swings up and down. One trader sees trending higher in the weeks ahead. That’s based on the May $40 calls. With 63 days until expiration, 10,039 contracts traded compared to a prior open interest of 305, for a 33-fold rise in volume on the trade. The buyer of the calls paid $0.90 to make the bullish bet. Alcoa shares recently traded for about $33, so ...

Read More About This

Read More About This

AI Fears Aside, Cloud Services Remain a Profitable Tech Niche

Investor expectations for AI’s performance have slid in recent weeks. That’s amid the rise of new AI programs such as China’s DeepSeek, which claims to use fewer resources, and amid a growth scare in the general market. Either way, the AI trend is still on track to grow, irrespective of the price and valuation of many tech stocks. But it’s also a sign that investors should focus on AI-adjacent opportunities right now instead. One such opportunity? Cloud services. AI demand will keep ...

Read More About This

Read More About This

Insider Activity Report: American Express (AXP)

Michael Angelakis, a director at American Express (AXP), recently bought 3,700 shares. The buy is a new position for the director, and came to a total cost of $998,593. This is the first insider buy at American Express since October 2023. Otherwise, company executives have been regular sellers of shares, with a mix of option exercises and traditional sales. The company CEO has been a sizeable seller, albeit when shares were trading at far higher prices. Overall, American Express insiders own ...

Read More About This

Read More About This

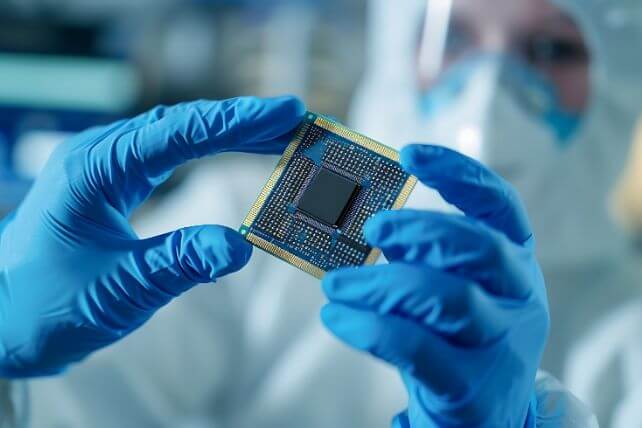

Unusual Options Activity: Arm Holdings (ARM)

Semiconductor developer and manufacturer Arm Holdings (ARM) is down 14% over the past year, as shares have recently given up their recent gains. One trader sees a rebound into the summer. That’s based on the August $125 calls. With 155 days until expiration, 4,189 contracts traded compared to a prior open interest of 129, for a 32-fold rise in volume on the trade. The buyer of the calls paid $14.70 to make the bullish bet. Arm shares recently traded for about $112, ...

Read More About This

Read More About This

Growth Potential and Consumer Spending Trends Could Make This Stock a Winner

Over the past few years, consumers have become more price conscious about many goods, but have continued to spend on services. Experiences such as travel and vacations have continued to thrive, and still look like strong trends. However, consumers may potentially want to start looking for deals there. Companies that can cater to consumers looking for a deal may be able to see continued strength as this trend shifts towards bargain hunting. For vacations, that could be a boon for Airbnb (ABNB) ...

Read More About This

Read More About This

Insider Activity Report: Northern Oil & Gas (NOG)

Nicholas O’Grady, CEO of Northern Oil & Gas (NOG), recently picked up 1,000 shares. The buy increased his position by less than 1%, and came to a total cost of $27,480. The buy came a few days after a company director bought 20,000 shares, paying just over $552,000 to increase his position by 6%. A second company director also recently picked up over 40,000 shares, for a buy of over $1.1 million. This cluster buy is in sharp contrast to the past ...

Read More About This

Read More About This