Introduction:

Investors tend to love options in bull markets.

But options mostly expire worthless. And a directional options trade like buying just a call option or a put option may not be ideal during flat, bear, or volatile markets.

In this report, we’ll show investors can use option strategies to win the overwhelming majority of their trades.

By following one of the key pieces of options data available to any trader, you’ll be able to identify an option whose risk level matches your needs.

Then, combined with a few different strategies, you can use this tool to consistently win when trading in the options market.

Let’s get started…

Options 101:

Given the explosion of options trading by retail investors during the 2020-2021 bull market, many traders jumped in without fully realizing what an option contract is or how options work.

Here’s a brief summary of the key terms you need to know:

An option is a contract that gives the buyer the right (but not the obligation), to buy 100 shares of a stock at a set time and for a set price. The seller of an option has an obligation, but not a right.

A call option is an options contract that rises in value as a stock rises.

A put option is an option that rises in value as a stock falls.

The set time for the option is the strike date. The set price for the stock is the strike price.

If a stock is trading for $100 per share, a trader with a call option with a $100 strike price has an option trading at-the-money.

If they have an option with a $90 strike price, the option is in-the-money.

If that trader has an option with a $110 strike price, the option is out-of-the-money.

Because an option allows a trader to control 100 shares of stock for a small fraction of owning that stock, it’s no surprise that traders have jumped in. But options can move differently than an underlying stock.

The value of an option is expressed as a price per share. So an option listed at $10 really costs $1,000, or $10 times the 100 shares represented by the option contract.

Traders like options because it seems like the potential gains are far greater than buying shares. Buying $100 call options on a stock trading at $100 may cost a trader $10.

But if that stock moves to $200, the share owners see a double, or 2-fold return. But the $100 option is worth $100 when the stock trades for $200, for a 10-fold gain.

That said, such options returns require good timing. Investors buying these options usually see them expire worthless.

That’s why most options traders gravitate towards strategies with a higher likelihood of winning.

Let’s look at the key way to identify whether an option will be a winner or loser… and the best strategies to profit on them.

How Options Traders Can Improve Their Chances of Success

Many traders get into an options trade thinking about how to best capture a stock’s move up or down.

By using a number of different strategies, investors can improve their chances of a winning trade while lowering their risk.

One key way is by looking at an option’s delta. That’s how much an option’s value may move depending on a $1 move up or down in the underlying stock.

Delta allows options traders to get a rough comparison as to the profit potential of any trade.

Every brokerage platform provides you with an option’s delta. It’s usually expressed as a fraction of 1.0.

So an option with a high delta might read as 0.95, and a low delta might read as 0.01. A delta on a call option will rise the more in-the-money in the option is.

Deltas can also be negative, typically seen with put options. In that case, an in-the-money put option will have a delta trending towards -1.0. And an out-of-the-money delta will trend to -.01.

For an at-the-money trade, a call option will have a delta near 0.50, and for a put option, the delta will be -0.50.

By picking the delta, traders can basically know what the odds are of the trade being a winner or not. Higher deltas are riskier, but can potentially deliver higher rewards.

Delta also gives investors a rough idea of the chance of an option being assigned, or closing in-the-money.

Simply multiply out the amount of the delta. So a 0.2 delta becomes a 20% chance of being assigned. Another way of saying that is that the option has an 80% chance (100% less the 20% chance) of closing out-of-the-money.

The same thing is true on the put side, just convert all numbers to positive ones. A -0.2 put delta becomes a 20% chance of being assigned, or having an 80% chance of expiring worthless.

Those looking to win a higher percentage of options trades would be wise to look at an option’s delta before making a trade.

With that in mind, let’s look at some of the best ways to trade options today, with an eye towards using an option’s delta to increase our chance of winning.

These strategies don’t offer the massive profit potential of simply buying a call option or put option ahead of a big move.

But they do offer consistent profits that can be replicated time and time again. It’s better to rack up a large number of small wins than swing for the fences and lose on your options trades time after time.

Considering an option’s delta when using these strategies can ensure that you lower your risk of loss when trading consistently.

Option Strategy #1: Put Selling

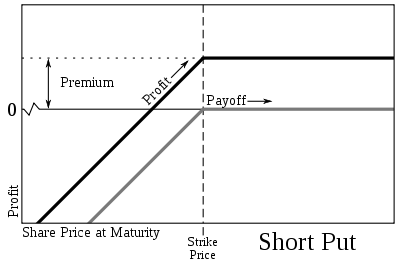

Put sellers are simply saying they’ll take on the risk of going long a company and buying shares, but only if it falls to a certain price first.

It’s a lot like selling an insurance contract. Put sellers are getting paid up front.

When the option expires, one of two things can happen. First, if the share price doesn’t move under the strike price of the option, the put seller can keep all the premium without having to buy shares.

That’s similar to how an insurance company gets to keep their annual premiums even if a motorist doesn’t get into an accident in a given year.

On the other side of the trade are put buyers, who expect the share price of an underlying stock to decline.

If it does decline, they’ll make money. If it drops enough, they can “put” shares to the put seller, who then owns shares.

In that scenario, the put seller still gets to keep the premium they sold, but now they own shares.

If the share price moves back up, they have an opportunity to make money from future capital gains on the shares. And as shareholders, they’ll be entitled to any dividend payments along the way.

Put selling allows investors to collect premiums betting against the decline of a company’s price. If it falls below the strike price, the put seller is obligated to buy shares at the strike price. Done correctly, this can be minimized to increase income-earning potential in a portfolio

Put selling works for a flat or bull market. In a bear market, put premiums tend to be higher. But there’s also a higher risk of being put shares of a company.

Since traders will need to have cash to buy shares, those who are doing too much put selling could quickly find themselves underwater.

Traders looking to sell a put option and get the best potential returns without being assigned shares should target an option delta with a low chance of being assigned – 0.2 or -0.2 or less.

Real-World Example:

Shares of Apple (AAPL) traded around $137 in early November 2022. December 16 puts, trading 39 days out, with a strike price of $95, carried a delta of -0.02.

In other words, this put sale opportunity had a roughly 98% chance of allowing a trader to safely profit on the trade. A trader who sold the put could have earned premiums of $0.22, or $22 per contract.

A trader willing to take a 20 percent chance of being assigned the contract could have sold the December $125 contracts for about $2.40 in premium, given that contract’s delta of -0.215.

Pros: Ease of use, can allow you to get paid to enter a trade at a lower price, or to generate modest amounts of income.

Cons: May require lots of cash/margin debt to be a useful strategy for smaller investors.

Option Strategy #2: Credit Spreads

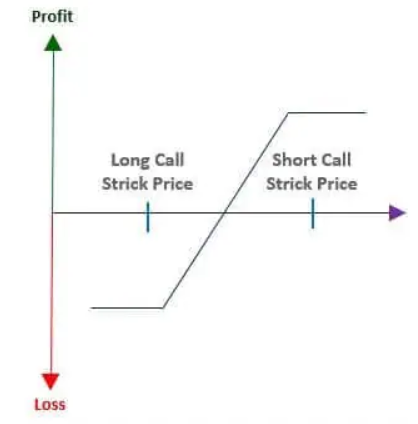

A credit spread involves simultaneously buying and selling options of the same class and same expiration date, but with different strike prices.

This lowers the risk of a one-sided trade, where there could be a 100% loss.

Investors first sell an option to raise cash, and then use the cash raised to buy an option at a lower price. Investors can then keep the spread between what they received in cash, less what they paid out to buy the other part of the spread.

Under this strategy, credit spreads offer investors a way to profit from declining option premium, much like selling a put option. But if shares go down, traders have a limited maximum loss from making the spread.

Traders have the options to set up a spread below or above the current market price for a stock, depending on market conditions, offering additional flexibility.

A credit spread involves the purchase and sale of one option in the same stock and expiration, but with different strike prices. Traders are looking to make a profit as the spreads between the two options narrow over time.

While this sounds complex, the beauty of the credit spread is that it has a high probability of profit.

By selling a credit spread far out of the money, traders can increase their winning profitability to over 80%. And by watching for low-delta options when making that spread, the chances of the entire spread paying off a profit increase further.

This strategy is also appealing for traders because it doesn’t have to be monitored daily. Traders can set the spread, and let the position play out until expiration, with no further adjustments needed.

With the right low-delta options in place, traders could use these spreads to earn up to 5% monthly. On an annualized rate, that should beat the average market return most years.

As with selling put options, using low-delta options will increase the chance of winning on this strategy every time.

Typically, moderately-priced spreads can create a profit for users 80% of the time. Using a lower-delta option, like 0.2 for calls, or -0.2 for puts, can increase those odds of success to over 90%.

Real World Example:

Let’s say that, in November 2022, with Apple (AAPL) shares trading around $137 that you expected the stock to move no higher than to $160 by the next month.

First, a trader would sell the $170 call option for $0.15.

Given that the December $170 calls had a delta of 0.024, there is about a 98% chance that this trade would play out and provide a trader with a net profit.

Then, a trader would then go and buy the December 16 $160 calls. At the time, this call option could have been sold for $0.54.

As long as Apple shares rose higher, but not over $160, the long-call trade would appreciate in value. The $170 call may rise as well.

But both options will also lose time value. Traders would then look to take profits on the $160 call, and buy back the sold $170 call at a lower price when there was less time value on the table.

Pros: Much safer than a directional bet, and can make for safe, consistent profits

Cons: Lower profit potential than a one-way bet, still require traders to trade with margin

Option Strategy #3: Iron Condors

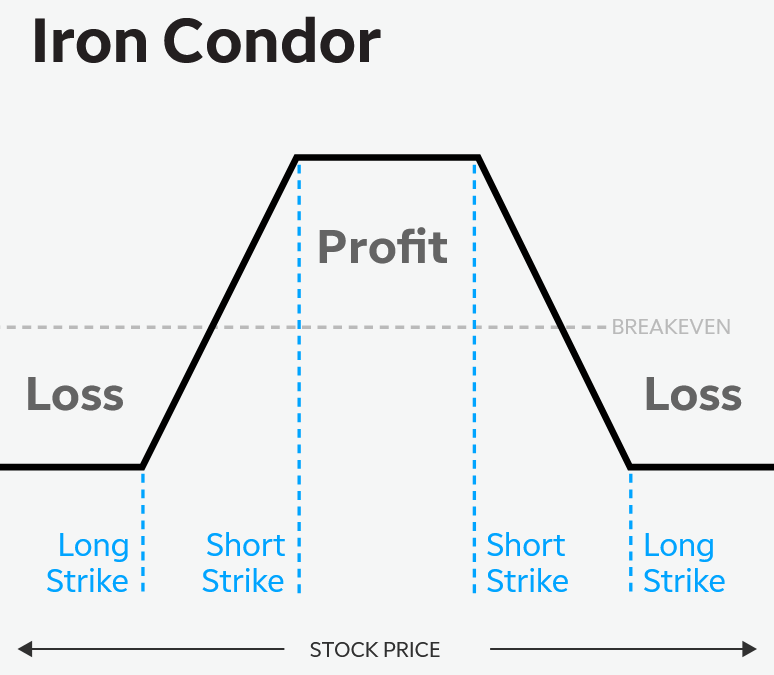

This strategy builds on the credit spread. It involves two call options and two put options.

Essentially, the iron condor combines an out-of-the-money short put spread an out-of-the-money short call spread. The options all expire on the same date.

The short put spread is bullish, as that side of the trade will increase in value as shares rise.

The short call spread is bearish, as that side of the trade should increase in value as shares decline.

Because the trade as a whole uses four different options expiring at the same time, traders looking to avoid assignment in any part of the trade should look for low-delta options.

That’s where a value of 0.2 or less on calls and -0.2 or less on puts come into place.

Obviously, traders who are more knowledgeable about a specific stock’s potential to make big moves could go a little further up on delta.

Think about it this way: Selling two different out-of-the-money vertical spreads means collecting the premiums from both sides of the iron condor as one order.

However, a share price can’t be both higher or lower at once. So at expiration, only one spread can go against traders. The other spread should gain enough to earn an overall profit on the trade.

An iron condor offers traders a way to consistently earn a profit trading a stock that seems to be stuck in a range. That could be specific to the stock, or a result of a sideways market.

As seen on the chart below, the peak profit potential occurs in the mid-range of the option strike prices.

The iron condor strategy simply uses two credit spreads, one long and one short. The notion is to allow the declining value of the options sold to create a modest, but consistent profit over time, above the costs to hedge the trade from uncapped losses

Real World Example:

Once again returning to market giant Apple, let’s say a trader in November 2022 sets up an iron condor one month out with the expectation that shares will trade between $155 and $165 in December.

In that case, the trader would set up four options trades.

First, the trader would sell the December $150 calls, netting $1.87. And they would sell the December $170 calls, grabbing $0.15.

That would give the trader cash of $2.02, or $202 for every one of the options contracts sold.

That trader would buy the December 16 $155 calls, paying about $1.02. They would also buy the December $165 calls, paying about $0.29.

That would cost $1.31 in total. That would net the trader $0.71 per share, or $71 in total. As long as apple shares stayed between $155 and $165 by expiration, the trader would keep that maximum profit.

Pros: Great for low-volatility stocks and markets.

Cons: Requires margin to use, potential profits are capped.

Conclusion:

Options trading can be exciting. But when done right, it can be consistently profitable.

While those returns may be lower, increasing your chances of winning on each options trade makes it easier to profit in any market condition.

That’s where an option’s delta comes into play. The delta gives a quick way of looking at a stock’s underlying volatility, and the likelihood that any given option on that stock will expire in-the-money or out-of-the-money.

Finding options with low delta is the key to increasing your win rate with options trading.

It can increase the chances of finding call or put options likely to expire worthless – an ideal trait to know when selling either of those options.

It can also increase your success with investment strategies like credit spreads or iron condors. While these trades involve multiple stages, the chances of making consistent profits will increase over time when factoring in an option’s delta.

That’s how astute options traders are able to up their win rate – to potentially 98% of the time.

Factoring an option’s delta into your trading strategies can lead to a much happier investment return over time.