Michael Strachan, a director at Marvell Technology (MRVL), recently picked up 6,781 shares. The buy increased his stake by over 13 percent, and came to a total cost just over $314,000.

This marks the first insider buy at the company since early 2021. Over the past three years, insider shave been regular and consistent sellers of shares, a normal trend for a big-cap tech company.

Overall, company insiders own about 0.6 percent of shares.

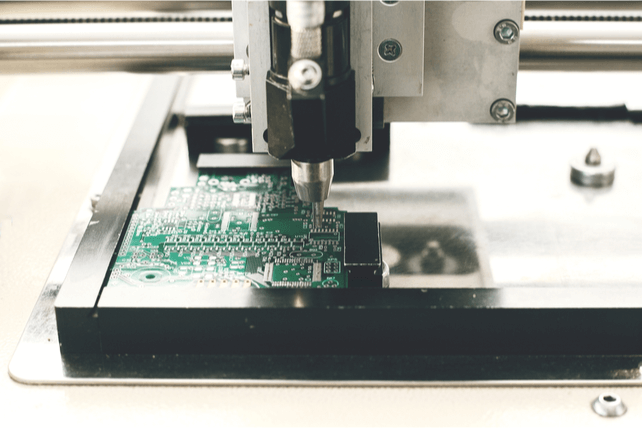

The semiconductor giant is down 25 percent in the past year, and nearly 50 percent off its 52-week high. While the company hasn’t been profitable this year, revenues have surged 41 percent thanks to strong demand for semiconductors.

Action to take: the company is a leading player in a number of integrated circuits, and will likely continue to grow in time. The selloff in shares has sent the stock from 42 times earnings expectations last year to under 20 times now. Investors should look to use down days for the stock to pick up more shares.

For traders, the stock has been in a downtrend this year. That may continue in the coming weeks. The December $45 puts, last going for about $4.35, are a near-the-money trade that could deliver mid-to-high double-digit returns on a further drop.

Disclosure: The author of this article has no position in the company mentioned here, but may trade after the next 72 hours. The author receives no compensation from any of the companies mentioned in this article.