Shares of conglomerate 3M (MMM) have been trading in a range for the past few months. One trader sees the shares moving higher, potentially out of its trading range and into a new rally.

That’s based on the September $210 calls. Over 10,200 contracts traded against an open interest of 272, for a 38-fold rise in volume. The buyer of the calls paid about $2.42 to make the trade.

With shares around $200, a move to $210 represents about a 5 percent move higher in the next 56 days before the options expire.

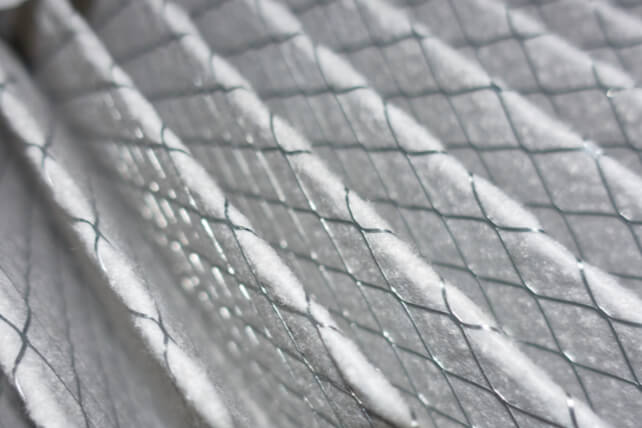

Shares have slightly underperformed the S&P 500 in the past year. The company was one of many to benefit from the pandemic, as the firm is a key manufacturer of safety equipment such as air filters that can be used to help curb the spread of viruses.

Action to take: Shares of the company trade around 20 times earnings, but the company does own hundreds of brands where it leads in sales for that niche. Investors may like shares, which yield just under 3 percent right now, and with a dividend that tends to get raised annually.

The September options are potentially risky if shares stay in their range, but for the cost, a rally to new highs could lead to high-double or even low-triple digit returns.

Disclosure: The author of this article has no position in the company mentioned here, but may make a trade after the next 72 hours. The author receives no compensation from any of the companies mentioned in this article.