Precious metals producer Alamos Gold (AGI) has fared well over the past year, with a 44 percent gain. One trader sees a further rally in the months ahead.

That’s based on the June $17.50 calls. With 74 days until expiration, 10,512 contracts traded compared to a prior open interest of 159, for a 66-fold rise in volume on the trade. The buyer of the calls paid $0.10 to make the bullish bet.

Shares recently traded for just under $12.50, so they would need to rise over $5, or nearly 43 percent, for the option to move in-the-money.

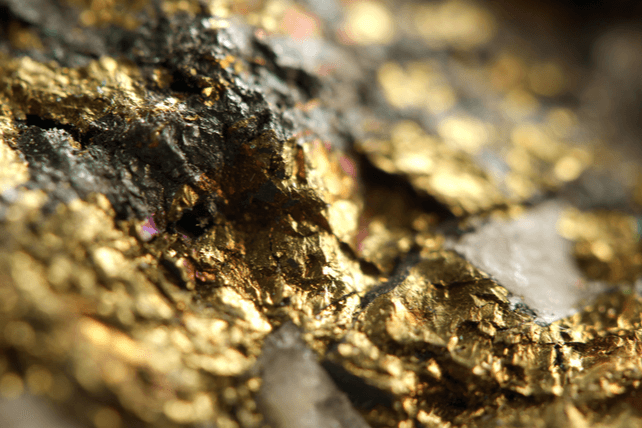

Such a move would likely occur if gold prices solidly broke over $2,000 per ounce. The metal has neared that price in recent weeks as inflation appears likely to stay higher for longer, and with the prospect of interest rates peaking in the near future.

Alamos has grown revenues 14 percent and earnings by nearly 38 percent over the past year, and a continued move higher for gold prices would likely see those numbers move even higher.

Action to take: Investors may like shares here as a way to play gold prices higher, as gold mining stocks tend to perform better than the metal itself during a rally. Alamos also yields 0.8 percent right now.

For traders, the June $17.50 calls are inexpensive, and could potentially deliver triple-digit returns. Coming from a low price, there’s also limited downside. That makes this an inexpensive bet on gold prices moving higher in the months ahead.

Disclosure: The author of this article has no position in the company mentioned here, but may trade after the next 72 hours. The author receives no compensation from any of the companies mentioned in this article.