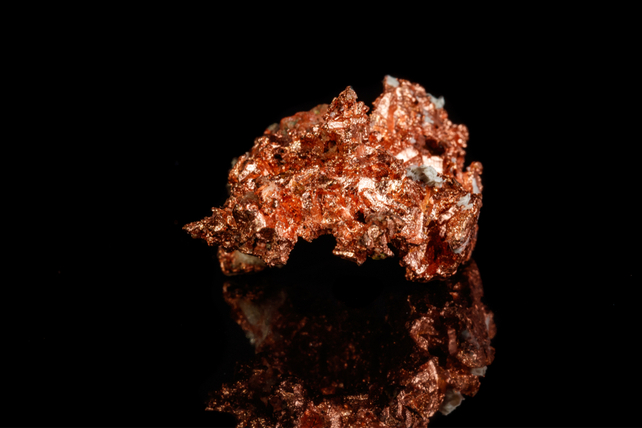

Copper giant Freeport McMoRan (FCX) has been on a tear, and one trader sees shares continuing to move even higher in the next few months.

That’s based on the May $42 calls. Expiring in 88 days, over 3,250 contracts traded recently, a 20-fold rise in volume from the prior open interest of 163. Shares would need to rise another 13.5 percent for the option to move in-the-money before expiration. The trader paid about $2.41 to make the trade.

Freeport shares jumped over 7.4 percent on Friday, and the stock is near a multi-year high on a strong uptrend. Shares have traded as low as $5 over the past year. The stock’s all-time high has been $60, hit just before the 2008 drop, so there’s still more potential room for shares of the copper producer to run.

Action to take: Given the strong uptrend, as well as shortages in areas such as copper, it’s clear why shares have been in an uptrend. That’s also why traders may want to get in on this trade. Shares are a bit overbought on a technical basis, but the fundamentals for copper are strong and have been years in the making. Traders could potentially nab triple-digit gains on this option if the current uptrend continues.