Shares of mining giant Freeport-McMoRan (FCX) have been in a strong uptrend until the past few trading days, when shares quickly dropped. One trader sees the stock returning to rally mode.

That’s based on the August $49 calls. With 112 days until expiration, 3,283 contracts traded compared to a prior open interest of 121, for a 27-fold rise in volume on the trade. The buyer of the calls paid $2.21 to get into the position.

Shares last traded just under $42, so they would need to rise more than $7, or about 17.5 percent, for the calls to move in-the-money.

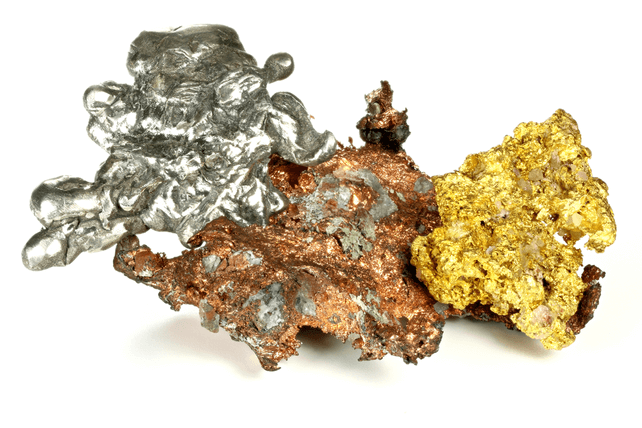

Following the recent decline in shares from a 52-week high near $52, the company is just barely up over the past year. But revenue is up 37 percent, and earnings are up 56 percent, largely on the back of strong copper prices. And profit margins have hit 18 percent, an excellent showing for a commodity-producing company.

Action to take: Investors may like shares here. The company recently doubled its dividend payout, and today’s buyers can get a 1.5 percent starting yield, with more room for potential growth if commodity prices stay strong. Plus, shares are still inexpensive at 12 times current and forward earnings.

For traders, the August calls have plenty of time to play out, and a rally in the 17 percent range is possible in the coming months. That makes the option capable of mid-to-high double-digit returns in the months ahead.

Disclosure: The author of this article has no position in the company mentioned here, but may trade after the next 72 hours. The author receives no compensation from any of the companies mentioned in this article.