The Big Money Is Placing Their Bets on Beaten-Down Winners Now

It’s no surprise that investors who follow company insiders can make above-average returns over time. Company insiders are knowledgeable about their company and its operations. But following big-name investors after they build a stake in a company can make a similar profit. That’s because those who make a big buy can often earn board seats, and work on strategies to improve the business, sell off a division, or otherwise do something to result in better performance for investors. Activist investors have been ...

Read More About This

Read More About This

Follow Growth for Great Returns – Even If It Means Patience Now

Companies can’t control what the stock market is doing. That’s why great companies will sell off in a bear market along with poor ones. It also means that companies facing strong growth may continue to do so, even if the market doesn’t recognize the value in the short haul. Patient investors can use bear markets to buy into growth opportunities. It’s also a great time to weed out companies that looked like growth opportunities but haven’t been. One such growth opportunity right ...

Read More About This

Read More About This

For Better Investment Results, Capitalize on Multiple Fears

Markets are always bothered by something. That can lead to short-term opportunities that disappear when the fear does. That can include anything from a war to the current fears over how long the Fed will raise interest rates. Looking at a long-term chart of the stock market, it’s clear that fears pass, even if they’re later replaced with new ones when stocks have moved higher. Today, investors may see better returns from companies that are playing to multiple fears. For example, amid ...

Read More About This

Read More About This

Buy Beaten Down Winners Ahead of the Next Market Rally

Bear markets tend to occur every few years. And they include a selloff in all assets – whether of high quality or poor. It’s unusual for blue-chip names to take such a big hit in the span of a year without a strong recovery in the next year. Yet that’s where investors are today. Buying quality names on the cheap can lead to large returns in the years ahead, especially if the market is close to bottoming ahead of a recovery ...

Read More About This

Read More About This

Stick With Stocks That Have Inflation-Fighting Power

It’s become clear that last year’s rise in inflation hasn’t moderated yet. It may continue for some time. That can impact the economy in a number of ways. For investors, the biggest is how a company’s expenses can rise and profit margins can fall. In this environment, companies that can increase their prices to cover higher input costs can maintain their profit margins and fare well here. That may mean falling less than other stocks, or even seeing shares move higher ...

Read More About This

Read More About This

Stick With Companies Looking Forward Amid the Current Economic Slowdown

The market outlook is grim. Stocks continue to set new lows. Many companies are facing challenges. But a few are using this time of hardship to set themselves up for success when the economy turns around. While it can be challenging to look to the future when the present is fearful, growth must go on. And one sign of a great company is that it finds a new way to grow its business during a time of market fear when few ...

Read More About This

Read More About This

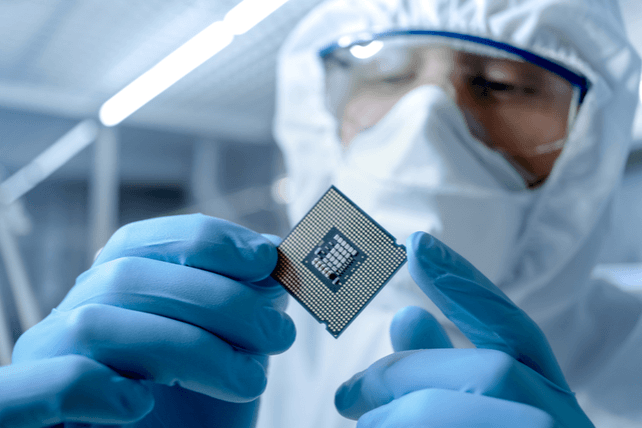

Pessimism In the Chip Space Is Getting Overblown – Buy This Top Name

Traders loved chip companies during the last bull market. In the current bear market? Not so much. Slowing PC sales, a declining economy, and supply chain issues have created a mess for the space. However, the space may have gone from being overly optimistic last year to overly pessimistic today. That suggests with all the downgrades and fear in the space that it may be time for contrarian investors to buy. A few analysts likewise see values now that shares are so ...

Read More About This

Read More About This

Look For Mispriced Opportunities in Bear Markets

A bear market wreaks havoc on corporate valuations. Increased uncertainty can cut back on potential deals, and cause companies with a variety of disparate divisions to become priced out of expectation with its potential value. Investors who look for these opportunities and exercise patience can get in on a great company at a good price. It’s a potentially classic case of being able to buy dollar bills for just fifty cents. One potential opportunity is inIAC Parts (IAC). The internet and media ...

Read More About This

Read More About This