Why This Strong Performing Player Can Continue Higher Now

The past six months have been devastating for growth companies. From the tech space to speculative startups to everything crypto, many of the well-known growth stories of the past year have seen their gains evaporate – and then some. However, the more slow-and-steady companies have been holding up far better now. And some even play to multiple favorable market trends now, which make them likely to continue performing well in the future. That latter category is whereBerkshire Hathaway (BRK-B) has been a ...

Read More About This

Read More About This

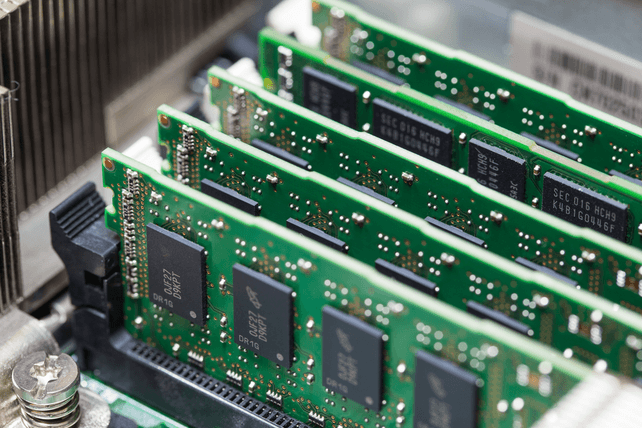

Long-Term Trends Bode Well for Tech Infrastructure Plays Now

Even with a modest slowdown in the overall economy in the first quarter of the year, and even with a potential recession if the second quarter also shows a slowdown, the world continues to improve. New technologies and networks are rolled out. New ideas hit the drawing board. And there’s still ample demand for those products to make an investment in the right tech stocks now a worthwhile one. With a number of new developments in the space, semiconductor companies are likely ...

Read More About This

Read More About This

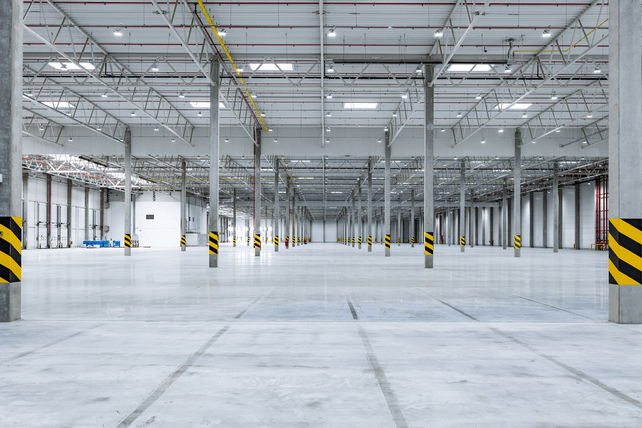

Slow and Steady Still Makes Real Estate A Compelling Sector For Investors Now

Real estate has been holding up better than the stock market. Even rising interest rates are seen as a potential way to cool the rapidly-rising housing market. Other parts of the real estate market have likewise held up well, but have different dynamics that should enable more value to be unlocked ahead. One such area is in industrial real estate. Most investors can’t or don’t want to own this space directly, so a number of REITs exist to make it easy. Industrial ...

Read More About This

Read More About This

Stick With Strong Brands and Intellectual Properties in Today’s Markets

With the stock market significantly off its highs, investors are looking for companies that can deliver on strong earnings right now. This earnings season, companies with strong brands and intellectual properties have been able to hold up relatively well. That’s a trend likely to continue going forward, as investors pull back from newer and riskier ventures with unknown prospects for the future. Such companies also tend to have the ability to raise prices better to counteract inflation, while still retaining customers. One such ...

Read More About This

Read More About This

One Top Play Amid the Crypto Carnage

Cryptocurrencies took a major dive on Monday, as the largely unregulated space allows traders to use more leverage than in other financial markets. And companies catering to the space likewise underperformed the stock market’s large drop. However, changes based on the price of cryptocurrencies may be misleading. That’s because rising adoption and investment in the space is creating a value for a number of companies catering to the industry. Case in point isCoinbase (COIN). The crypto brokerage benefits from the large volume ...

Read More About This

Read More About This

Follow the World’s Safest Long-Term Investment Strategy Now

Investors looking to go long on stocks right now could be in for a wild ride. But over time, a few strategies can ensure that buying during this period of market fear leads to great results. While the market selloff of the past few months may lead to investors swearing off of stocks, chances are it won’t be long before investors start piling into the next fad. However, one strategy stands the test of time. And that’s investing in companies that pay ...

Read More About This

Read More About This

Growing Consumer Goods Companies Look Like a Market Safe-Haven Now

Stocks are closing in on a bear market, as rising inflation seems to be out of control, even with the Federal Reserve hiking interest rates. However, some areas of the market are holding up well. A few consumer goods companies are able to see solid growth and revenue, while also passing off higher costs to consumers. These companies tend to hold up well in down markets, even though they don’t get much respect during a stock market rally. The perfect example of ...

Read More About This

Read More About This

This Unusual Commodity Is Set for a Great Few Years, No Matter What the Economy Does

Commodities have been in a bull market for some time. But with oil prices well off their highs, and with precious metals failing to break higher even with high inflation rates, prices have moderated somewhat. But some commodities have stronger fundamentals, especially in the years ahead. The metals space is one area, as a recovering global economy has greater demand for these commodities than the current supply. One such commodity is lithium. Critical for rechargeable batteries in everything from cell phones to ...

Read More About This

Read More About This