Unusual Options Activity: ConocoPhillips (COP)

Major oil and gas producer

ConocoPhillips (COP) jumped over 9 percent on Monday as oil prices rallied on news of OPEC cuts. One trader sees shares continuing higher in the coming weeks. That’s based on the April 28 $107 calls. With 23 days until expiration, 11,135 contracts traded compared to a prior open interest of 109, for a 102-fold jump in volume on the trade. The buyer of the calls paid $4.55 to make the bullish bet. Shares last went for just over ...

Read More About This

ConocoPhillips (COP) jumped over 9 percent on Monday as oil prices rallied on news of OPEC cuts. One trader sees shares continuing higher in the coming weeks. That’s based on the April 28 $107 calls. With 23 days until expiration, 11,135 contracts traded compared to a prior open interest of 109, for a 102-fold jump in volume on the trade. The buyer of the calls paid $4.55 to make the bullish bet. Shares last went for just over ...

Read More About This

Unusual Options Activity: Valley National Bancorp (VLY)

Regional bank

Valley National Bancorp (VLY) has seen shares slide 25 percent in the past few weeks amid fears in the banking sector. One trader sees further downside ahead for the stock. That’s based on the September $5 puts. With 163 days until expiration, 9,954 contracts traded compared to a prior open interest of 265, for a 38-fold jump in volume on the trade. The buyer of the puts paid $0.48 to make the bearish bet. Shares recently traded just over $9, ...

Read More About This

Valley National Bancorp (VLY) has seen shares slide 25 percent in the past few weeks amid fears in the banking sector. One trader sees further downside ahead for the stock. That’s based on the September $5 puts. With 163 days until expiration, 9,954 contracts traded compared to a prior open interest of 265, for a 38-fold jump in volume on the trade. The buyer of the puts paid $0.48 to make the bearish bet. Shares recently traded just over $9, ...

Read More About This

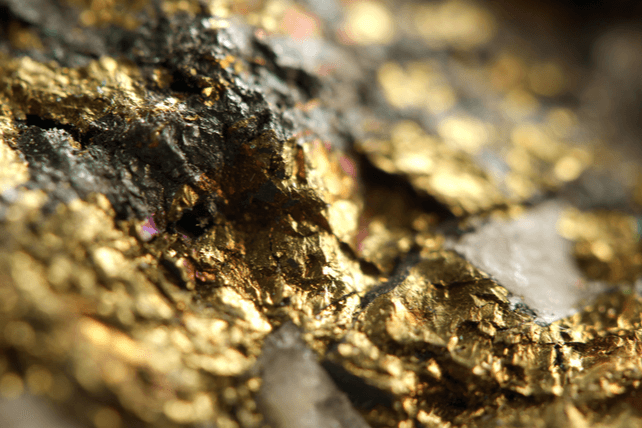

Unusual Options Activity: Alamos Gold (AGI)

Precious metals producer

Alamos Gold (AGI) has fared well over the past year, with a 44 percent gain. One trader sees a further rally in the months ahead. That’s based on the June $17.50 calls. With 74 days until expiration, 10,512 contracts traded compared to a prior open interest of 159, for a 66-fold rise in volume on the trade. The buyer of the calls paid $0.10 to make the bullish bet. Shares recently traded for just under $12.50, so they would ...

Read More About This

Alamos Gold (AGI) has fared well over the past year, with a 44 percent gain. One trader sees a further rally in the months ahead. That’s based on the June $17.50 calls. With 74 days until expiration, 10,512 contracts traded compared to a prior open interest of 159, for a 66-fold rise in volume on the trade. The buyer of the calls paid $0.10 to make the bullish bet. Shares recently traded for just under $12.50, so they would ...

Read More About This

Unusual Options Activity: MetLife (MET)

Insurance giant

MetLife (MET) is down 22 percent over the past year, lagging the S&P 500. One trader sees the company continuing to slide even lower. That’s based on the September $42.50 puts. With 168 days until expiration, 3,004 contracts traded compared to a prior open interest of 109, for a 28-fold rise in volume on the trade. The buyer of the puts paid $1.18 to make the downside bet. With shares trading at about $56.50, the stock is still within 10 ...

Read More About This

MetLife (MET) is down 22 percent over the past year, lagging the S&P 500. One trader sees the company continuing to slide even lower. That’s based on the September $42.50 puts. With 168 days until expiration, 3,004 contracts traded compared to a prior open interest of 109, for a 28-fold rise in volume on the trade. The buyer of the puts paid $1.18 to make the downside bet. With shares trading at about $56.50, the stock is still within 10 ...

Read More About This

Unusual Options Activity: Alibaba (BABA)

Chinese tech giant

Alibaba (BABA) soared on Tuesday, amid news that the company would break into six separate companies. One trader sees further upside ahead as those plans move forward. That’s based on the August $125 calls. With 140 days until expiration, 9,704 contracts traded compared to a prior open interest of 262, for a 37-fold rise in volume on the trade. The buyer of the calls paid $4.75 to get in. Shares recently traded for about $99, so the stock would need ...

Read More About This

Alibaba (BABA) soared on Tuesday, amid news that the company would break into six separate companies. One trader sees further upside ahead as those plans move forward. That’s based on the August $125 calls. With 140 days until expiration, 9,704 contracts traded compared to a prior open interest of 262, for a 37-fold rise in volume on the trade. The buyer of the calls paid $4.75 to get in. Shares recently traded for about $99, so the stock would need ...

Read More About This

Unusual Options Activity: International Business Machines (IBM)

Server and computer company

International Business Machines (IBM) have dropped 4 percent in the past year, outperforming the overall stock market by about 9 points. One trader sees a further decline for shares in the weeks ahead. That’s based on the April 21 $116 puts. With 23 days until expiration, 3,949 contracts traded compared to a prior open interest of 199, for a 33-fold rise in volume on the trade. The buyer of the puts paid $0.56 to make the bearish bet. The ...

Read More About This

International Business Machines (IBM) have dropped 4 percent in the past year, outperforming the overall stock market by about 9 points. One trader sees a further decline for shares in the weeks ahead. That’s based on the April 21 $116 puts. With 23 days until expiration, 3,949 contracts traded compared to a prior open interest of 199, for a 33-fold rise in volume on the trade. The buyer of the puts paid $0.56 to make the bearish bet. The ...

Read More About This

Unusual Options Activity: MGM Resorts International (MGM)

Hotel and casino operator

MGM Resorts International (MGM) are down just 2 percent over the past year, outperforming the overall stock market by about 10 percent. One trader sees shares declining in the coming weeks. That’s based on the May $40 puts. With 51 days until expiration, 5,137 contracts traded compared to a prior open interest of 163, for a 32-fold rise in volume on the trade. The buyer of the puts paid $2.01 to make the trade. Shares last went for ...

Read More About This

MGM Resorts International (MGM) are down just 2 percent over the past year, outperforming the overall stock market by about 10 percent. One trader sees shares declining in the coming weeks. That’s based on the May $40 puts. With 51 days until expiration, 5,137 contracts traded compared to a prior open interest of 163, for a 32-fold rise in volume on the trade. The buyer of the puts paid $2.01 to make the trade. Shares last went for ...

Read More About This

Unusual Options Activity: Deutsche Bank (DB)

Major international money center bank

Deutsche Bank (DB) has been under pressure, and shares are down 20 percent over the past year. One trader sees further weakness in the coming months. That’s based on the May $8 puts. With 53 days until expiration, 13,388 contracts traded compared to a prior open interest of 369, for a 36-fold rise in volume on the trade. The buyer of the puts paid $0.80 to make the bearish bet. Deutsche Bank shares recently went for about $9.50, ...

Read More About This

Deutsche Bank (DB) has been under pressure, and shares are down 20 percent over the past year. One trader sees further weakness in the coming months. That’s based on the May $8 puts. With 53 days until expiration, 13,388 contracts traded compared to a prior open interest of 369, for a 36-fold rise in volume on the trade. The buyer of the puts paid $0.80 to make the bearish bet. Deutsche Bank shares recently went for about $9.50, ...

Read More About This