Unusual Options Activity: Electronic Arts (EA)

Shares of video game developer

Electronic Arts (EA) have been somewhat rangebound in the past year. However, one trader is betting on a move higher in the coming months. That’s based on the September $150 calls. With 113 days until expiration, 5,049 contracts traded hands compared to a prior open interest of 387, for a 13-fold rise in volume on the shares. The buyer of the calls paid $5.73 to get into the trade. Shares last went for about $137, so they ...

Read More About This

Electronic Arts (EA) have been somewhat rangebound in the past year. However, one trader is betting on a move higher in the coming months. That’s based on the September $150 calls. With 113 days until expiration, 5,049 contracts traded hands compared to a prior open interest of 387, for a 13-fold rise in volume on the shares. The buyer of the calls paid $5.73 to get into the trade. Shares last went for about $137, so they ...

Read More About This

Unusual Options Activity: Starbucks (SBUX)

Shares of coffeehouse chain

Starbucks (SBUX) have lost more than one-third of their value in the past year. One trader sees the potential for a rally in shares in the second half of the year. That’s based on the December $85 calls. With 205 days until expiration, 46,245 contracts traded compared to a prior open interest of 485, for a 95-fold surge in volume on the trade. The buyer of the calls paid $3.06 to get into the trade. Shares recently traded around ...

Read More About This

Starbucks (SBUX) have lost more than one-third of their value in the past year. One trader sees the potential for a rally in shares in the second half of the year. That’s based on the December $85 calls. With 205 days until expiration, 46,245 contracts traded compared to a prior open interest of 485, for a 95-fold surge in volume on the trade. The buyer of the calls paid $3.06 to get into the trade. Shares recently traded around ...

Read More About This

Unusual Options Activity: Bloomin’ Brands (BLMN)

Shares of restaurant chain

Bloomin’ Brands (BLMN) have shed nearly one-third of their value in the past year. However, one trader sees the possibility for a rebound in the second half of the year. That’s based on the January 2023 $15 calls. With 241 days until expiration, 10,000 contracts traded compared to a prior open interest of 23, for a 43-fold rise in volume on the trade. The buyer of the calls paid $5.80 to get in. The stock recently traded just ...

Read More About This

Bloomin’ Brands (BLMN) have shed nearly one-third of their value in the past year. However, one trader sees the possibility for a rebound in the second half of the year. That’s based on the January 2023 $15 calls. With 241 days until expiration, 10,000 contracts traded compared to a prior open interest of 23, for a 43-fold rise in volume on the trade. The buyer of the calls paid $5.80 to get in. The stock recently traded just ...

Read More About This

Unusual Options Activity: Transocean (RIG)

Shares of offshore drilling equipment company

Transocean (RIG) are up about 7 percent in the past year. One trader sees the potential for share to fall in the months ahead. That’s based on the May 2023 $3.00 puts. With 361 days until expiration, 10,032 contracts traded compared to a prior open interest of 352, for a 29-fold rise in volume on the trade. The buyer of the puts paid $0.60 to get into the trade. Shares recently traded for about $4.00, so ...

Read More About This

Transocean (RIG) are up about 7 percent in the past year. One trader sees the potential for share to fall in the months ahead. That’s based on the May 2023 $3.00 puts. With 361 days until expiration, 10,032 contracts traded compared to a prior open interest of 352, for a 29-fold rise in volume on the trade. The buyer of the puts paid $0.60 to get into the trade. Shares recently traded for about $4.00, so ...

Read More About This

Unusual Options Activity: FedEx Corporation (FDX)

Shares of freight and logistics company

FedEx Corporation (FDX) have lost over one-third of their value in the past year. One trader is betting on a further decline. That’s based on the July $180 put. With 56 days until expiration, 15,182 contracts traded compared to a prior open interest of 661, for a 23-fold rise in volume on the trade. The buyer of the puts paid $6.80 to get in. Shares are a little bit off their 52-week low of $193, so ...

Read More About This

FedEx Corporation (FDX) have lost over one-third of their value in the past year. One trader is betting on a further decline. That’s based on the July $180 put. With 56 days until expiration, 15,182 contracts traded compared to a prior open interest of 661, for a 23-fold rise in volume on the trade. The buyer of the puts paid $6.80 to get in. Shares are a little bit off their 52-week low of $193, so ...

Read More About This

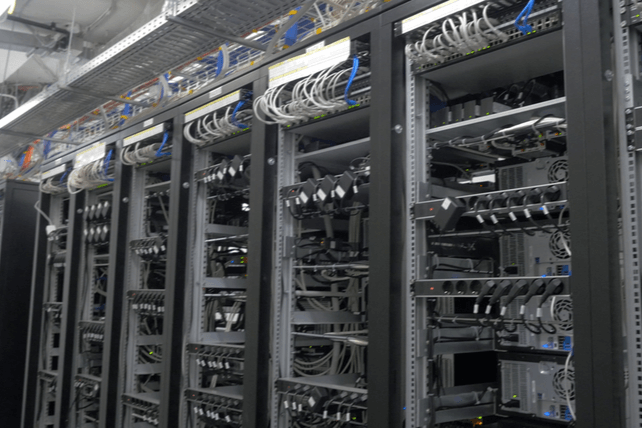

Unusual Options Activity: Cisco Systems (CSCO)

Shares of internet hardware provider

Cisco Systems (CSCO) have been in a downtrend for the past few months. One trader sees the prospect of further declines in the months ahead. That’s based on the June 2023 $45 puts. With 393 days until expiration, 4,001 contracts traded compared to an open interest of 183, for a 22-fold rise in volume. The buyer of the puts paid $3.73 to get into the trade. Shares last went for about $50, so the stock would need to ...

Read More About This

Cisco Systems (CSCO) have been in a downtrend for the past few months. One trader sees the prospect of further declines in the months ahead. That’s based on the June 2023 $45 puts. With 393 days until expiration, 4,001 contracts traded compared to an open interest of 183, for a 22-fold rise in volume. The buyer of the puts paid $3.73 to get into the trade. Shares last went for about $50, so the stock would need to ...

Read More About This

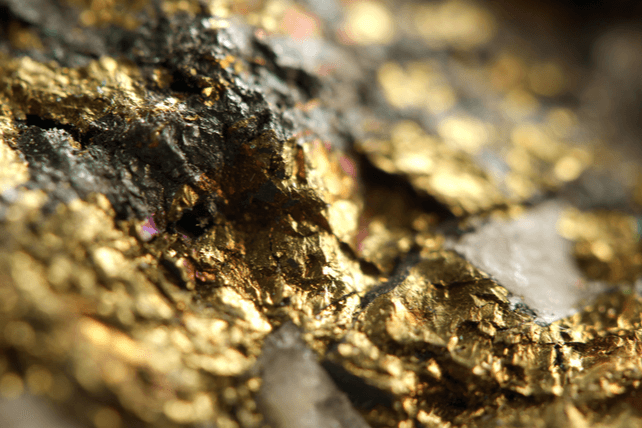

Unusual Options Activity: Agnico Eagle Mines (AEM)

Shares of gold producer

Agnico Eagles Mines (AEM) are off by over 30 percent in the past year, as gold prices have been lackluster. One trader, however, sees the possibility for a massive rally in the coming months. That’s based on the January 2024 $80 calls. With 611 days until expiration, 8,846 contracts traded hands compared to an open interest of 133, for a 67-fold increase in volume on the trade. The buyer of the calls paid $3.90. Shares last traded around $52, ...

Read More About This

Agnico Eagles Mines (AEM) are off by over 30 percent in the past year, as gold prices have been lackluster. One trader, however, sees the possibility for a massive rally in the coming months. That’s based on the January 2024 $80 calls. With 611 days until expiration, 8,846 contracts traded hands compared to an open interest of 133, for a 67-fold increase in volume on the trade. The buyer of the calls paid $3.90. Shares last traded around $52, ...

Read More About This

Unusual Options Activity: Synchrony Financial (SYF)

Shares of regional bank

Synchrony Financial (SYF) are trading near a 52-week low. One trader sees the stock moving even lower in the coming months. That’s based on the September $29 puts. With 122 days until expiration, 7,966 contracts traded compared to an open interest of 100, for an 80-fold surge in volume on the trade. The buyer of the puts paid $1.80 to make the downside bet. Shares last traded around $33.50, so the bank would need to drop more than 15 ...

Read More About This

Synchrony Financial (SYF) are trading near a 52-week low. One trader sees the stock moving even lower in the coming months. That’s based on the September $29 puts. With 122 days until expiration, 7,966 contracts traded compared to an open interest of 100, for an 80-fold surge in volume on the trade. The buyer of the puts paid $1.80 to make the downside bet. Shares last traded around $33.50, so the bank would need to drop more than 15 ...

Read More About This