Unusual Options Activity: Merck & Co (MRK)

Shares of pharmaceutical giant

Merck & Co (MRK) are up about 21 percent over the past year, and shares are close to 52-week highs. One trader sees the possibility for a pullback in the coming weeks. That’s based on the September $82.50 puts. With 79 days until expiration, 3,289 contracts traded compared to a prior open interest of 122, for a 27-fold rise in volume on the trade. The buyer of the puts paid $1.04 to get into the short position. The stock ...

Read More About This

Merck & Co (MRK) are up about 21 percent over the past year, and shares are close to 52-week highs. One trader sees the possibility for a pullback in the coming weeks. That’s based on the September $82.50 puts. With 79 days until expiration, 3,289 contracts traded compared to a prior open interest of 122, for a 27-fold rise in volume on the trade. The buyer of the puts paid $1.04 to get into the short position. The stock ...

Read More About This

Unusual Options Activity: The Walt Disney Company (DIS)

Shares of media giant

The Walt Disney Company (DIS) have slid in recent months along with the overall market. One trader sees a further decline in shares in the coming weeks. That’s based on the July 22 $100 puts. With 24 days until expiration, 5,040 contracts traded compared to a prior open interest of 129, for a 39-fold rise in volume on the trade. The buyer of the puts paid $4.80 to get into the trade. Shares recently traded for about $98, meaning ...

Read More About This

The Walt Disney Company (DIS) have slid in recent months along with the overall market. One trader sees a further decline in shares in the coming weeks. That’s based on the July 22 $100 puts. With 24 days until expiration, 5,040 contracts traded compared to a prior open interest of 129, for a 39-fold rise in volume on the trade. The buyer of the puts paid $4.80 to get into the trade. Shares recently traded for about $98, meaning ...

Read More About This

Unusual Options Activity: Marathon Digital Holdings (MARA)

Shares of cryptocurrency mining company

Marathon Digital Holdings (MARA) are down 77 percent in the past year, thanks largely to a decline in the price of Bitcoin. One trader is betting on a further decline through next year. That’s based on the January 2024 $2.50 puts. With 571 days until expiration, 11,496 contracts traded hands compared to a prior open interest of 288, for a 40-fold rise in volume on the trade. The buyer of the puts paid $1.11 to make the ...

Read More About This

Marathon Digital Holdings (MARA) are down 77 percent in the past year, thanks largely to a decline in the price of Bitcoin. One trader is betting on a further decline through next year. That’s based on the January 2024 $2.50 puts. With 571 days until expiration, 11,496 contracts traded hands compared to a prior open interest of 288, for a 40-fold rise in volume on the trade. The buyer of the puts paid $1.11 to make the ...

Read More About This

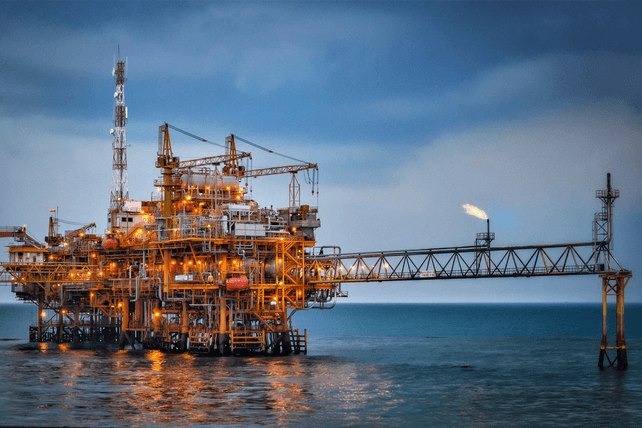

Unusual Options Activity: BP (BP)

Shares of oil and gas giant

BP (BP) have slid in recent days. One trader sees the possibility for a rebound into the start of next year. That’s based on the January 2023 $31 calls. With 210 days until expiration, 6,511 contracts traded compared to an open interest of 125, for a 52-fold rise in volume on the trade. The buyer of the calls paid $2.10 to get into the trade. The stock recently traded around $28, so shares would need to rise ...

Read More About This

BP (BP) have slid in recent days. One trader sees the possibility for a rebound into the start of next year. That’s based on the January 2023 $31 calls. With 210 days until expiration, 6,511 contracts traded compared to an open interest of 125, for a 52-fold rise in volume on the trade. The buyer of the calls paid $2.10 to get into the trade. The stock recently traded around $28, so shares would need to rise ...

Read More About This

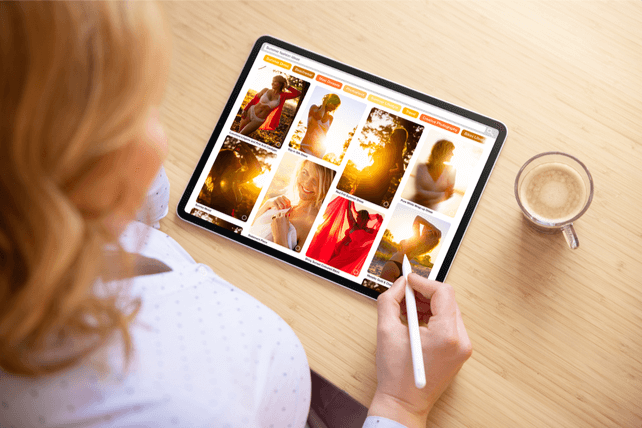

Unusual Options Activity: Pinterest (PINS)

Shares of online board

Pinterest (PINS) have shed 75 percent of their value in the past year. One trader sees the chance for a further decline in the coming few days. That’s based on the July 1 $15 puts. With 8 days until expiration, 19,778 contracts traded compared to a prior open interest of 116, for a 171-fold rise in volume on the trade. The buyer of the puts paid $0.10 to get into the trade. The stock recently traded for around $18, ...

Read More About This

Pinterest (PINS) have shed 75 percent of their value in the past year. One trader sees the chance for a further decline in the coming few days. That’s based on the July 1 $15 puts. With 8 days until expiration, 19,778 contracts traded compared to a prior open interest of 116, for a 171-fold rise in volume on the trade. The buyer of the puts paid $0.10 to get into the trade. The stock recently traded for around $18, ...

Read More About This

Unusual Options Activity: Magnite (MGNI)

Shares of advertising agency

Magnite (MGNI) have shed two-thirds of their value in the past year. One trader sees further downside going into the latter half of the year. That’s based on the January 2023 $12.50 puts. With 212 days until expiration, 3,950 contracts traded compared to a prior open interest of 131, for a 30-fold rise in volume on the trade. The buyer of the puts paid $4.30 to get in. Shares recently traded for just over $9.50, meaning the options are ...

Read More About This

Magnite (MGNI) have shed two-thirds of their value in the past year. One trader sees further downside going into the latter half of the year. That’s based on the January 2023 $12.50 puts. With 212 days until expiration, 3,950 contracts traded compared to a prior open interest of 131, for a 30-fold rise in volume on the trade. The buyer of the puts paid $4.30 to get in. Shares recently traded for just over $9.50, meaning the options are ...

Read More About This

Unusual Options Activity: Carvana (CVNA)

Shares of vehicle resale platform

Carvana (CVNA) are down over 91 percent in the past year. One trader sees a rebound ahead for the stock in the next 18 months. That’s based on the January 2024 $60 calls. With 577 days until expiration, 10,283 contracts traded compared to a prior open interest of 130, for a 95-fold surge in volume on the trade. The buyer of the calls paid $5.70 to get into the trade. Shares recently traded around $24, so they ...

Read More About This

Carvana (CVNA) are down over 91 percent in the past year. One trader sees a rebound ahead for the stock in the next 18 months. That’s based on the January 2024 $60 calls. With 577 days until expiration, 10,283 contracts traded compared to a prior open interest of 130, for a 95-fold surge in volume on the trade. The buyer of the calls paid $5.70 to get into the trade. Shares recently traded around $24, so they ...

Read More About This

Unusual Options Activity: Nvidia (NVDA)

Shares of graphics processing company

Nvidia (NVDA) have been knocked down heavily from their highs, and are now down year-over-year. One trader sees a further decline in the coming weeks. That’s based on the July 22 $155 puts. With 32 days until expiration, 16,161 contracts traded compared to an open interest of 213, for a 76-fold rise in volume on the trade. The buyer of the puts paid $11.60 to get into the trade. Shares last traded for about $156, so this ...

Read More About This

Nvidia (NVDA) have been knocked down heavily from their highs, and are now down year-over-year. One trader sees a further decline in the coming weeks. That’s based on the July 22 $155 puts. With 32 days until expiration, 16,161 contracts traded compared to an open interest of 213, for a 76-fold rise in volume on the trade. The buyer of the puts paid $11.60 to get into the trade. Shares last traded for about $156, so this ...

Read More About This