Unusual Options Activity: Altimmune (ALT)

Shares of biotechnology company

Altimmune (ALT) are up 28 percent over the past year, but are also up nearly four-fold from their 52-week lows. One trader sees shares giving back some of their recent gains. That’s based on the October $13 put. With 42 days until expiration, 6,077 contracts traded compared to a prior open interest of 104, for a 58-fold surge in volume. The buyer of the puts paid $1.70 to get into the trade. The stock recently traded around $20, ...

Read More About This

Altimmune (ALT) are up 28 percent over the past year, but are also up nearly four-fold from their 52-week lows. One trader sees shares giving back some of their recent gains. That’s based on the October $13 put. With 42 days until expiration, 6,077 contracts traded compared to a prior open interest of 104, for a 58-fold surge in volume. The buyer of the puts paid $1.70 to get into the trade. The stock recently traded around $20, ...

Read More About This

As Recession Fears Grow, Look for Recession-Resistant Companies on Market Drops

Typically, it’s taken two quarters of negative GDP growth to officially mark a recession. By the time that’s announced, some short or shallow recessions are already over. We’ve seen two negative quarters so far this year, but many are looking to change the definition given the strong job market and other factors. As the definition of a recession seems to be changing, it might be a good idea to rethink the idea of a recession-resistant company. Those are typically firms that engage ...

Read More About This

Read More About This

Insider Trading Report: Trustco Bank Corp (TRST)

Michael Ozimek, an executive vice president at

Trustco Bank Corp (TRST), recently picked up 2,500 shares. The buy increased his stake by nearly 63 percent, and came to a total price of just over $82,000. The buy comes after a number of other company insiders have been buyers in recent months, including an 1,800-share pickup from the company’s Chairman and CEO back in July for nearly $60,000. Over the past three years, company insiders have been almost entirely buyers of shares. Overall, company ...

Read More About This

Trustco Bank Corp (TRST), recently picked up 2,500 shares. The buy increased his stake by nearly 63 percent, and came to a total price of just over $82,000. The buy comes after a number of other company insiders have been buyers in recent months, including an 1,800-share pickup from the company’s Chairman and CEO back in July for nearly $60,000. Over the past three years, company insiders have been almost entirely buyers of shares. Overall, company ...

Read More About This

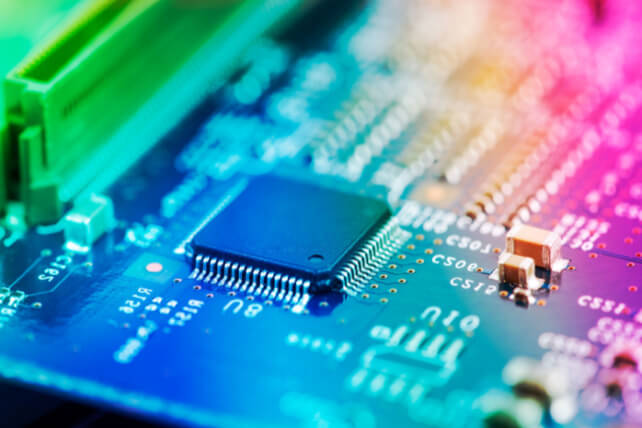

Unusual Options Activity: Texas Instruments (TXN)

Shares of semiconductor company

Texas Instruments (TXN) are down about 14 percent in the past year, about in-line with the overall stock market. One trader sees a further decline in the weeks ahead. That’s based on the November $160 puts. With 71 days until expiration, 5,075 contracts traded compared to a prior open interest of 113, for a 45-fold surge in volume on the trade. The buyer of the puts paid $8.60 to get into the trade. Shares recently traded for about $163, ...

Read More About This

Texas Instruments (TXN) are down about 14 percent in the past year, about in-line with the overall stock market. One trader sees a further decline in the weeks ahead. That’s based on the November $160 puts. With 71 days until expiration, 5,075 contracts traded compared to a prior open interest of 113, for a 45-fold surge in volume on the trade. The buyer of the puts paid $8.60 to get into the trade. Shares recently traded for about $163, ...

Read More About This

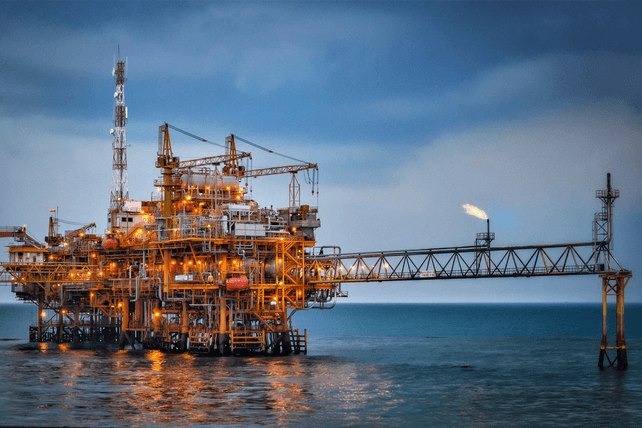

Time to Bet on This Winning Trade from the First Half of the Year

The stock market trended down in the first half of the year. Then, starting in late June, investors enjoyed a summer rally. Given the continuing strength in the economy and high inflation numbers, it’s likely that stocks will trend down as interest rates continue to rise. However, some assets can see a move higher here. That’s specifically true with assets that moved higher in the first half of the year, then took a breather when stocks rallied. One standout asset to perform ...

Read More About This

Read More About This

Insider Trading Report: CNA Financial Corp (CNA)

Loews Corp, a major owner of

CNA Financial Corp (CNA), recently added 168,099 shares. The buy increased the investment firm’s ownership by 0.1 percent, and came to a total cost just over $6.5 million. This is the first insider activity at the company since May, when one EVP sold some shares, while a company director was a buyer. Looking further back, company insiders have been regular and small sellers of shares, while institutional buyers have been consistently adding to their stake. Overall, company ...

Read More About This

CNA Financial Corp (CNA), recently added 168,099 shares. The buy increased the investment firm’s ownership by 0.1 percent, and came to a total cost just over $6.5 million. This is the first insider activity at the company since May, when one EVP sold some shares, while a company director was a buyer. Looking further back, company insiders have been regular and small sellers of shares, while institutional buyers have been consistently adding to their stake. Overall, company ...

Read More About This

Unusual Options Activity: Cameco (CCJ)

Shares of uranium producer

Cameco (CCJ) have risen 26 percent in the past year, on renewed interest in nuclear power and rising uranium prices. One trader sees that trend continuing through the end of the year. That’s based on the December $37 calls. With 100 days until expiration, 22,667 contracts traded compared to a prior open interest of 101, for a 224-fold explosion higher in volume. The buyer of the calls paid $1.40 to make the trade. Shares recently traded for about $29, ...

Read More About This

Cameco (CCJ) have risen 26 percent in the past year, on renewed interest in nuclear power and rising uranium prices. One trader sees that trend continuing through the end of the year. That’s based on the December $37 calls. With 100 days until expiration, 22,667 contracts traded compared to a prior open interest of 101, for a 224-fold explosion higher in volume. The buyer of the calls paid $1.40 to make the trade. Shares recently traded for about $29, ...

Read More About This

Slowing Growth Trends Point to Relative Winners

Many companies are coming off of strong earnings reports from the past year. Those numbers were influenced by the prior year, where pandemic shutdowns made things look horrific. Now, with the added challenge of a slowing economy and high inflation, investors need to weed through those companies likely to lose market share amid current market conditions and those that can eke out a larger stake in their sector. As the retail space looks to condense, a few big box stores look like ...

Read More About This

Read More About This