Insider Trading Report: Desktop Metal (DM)

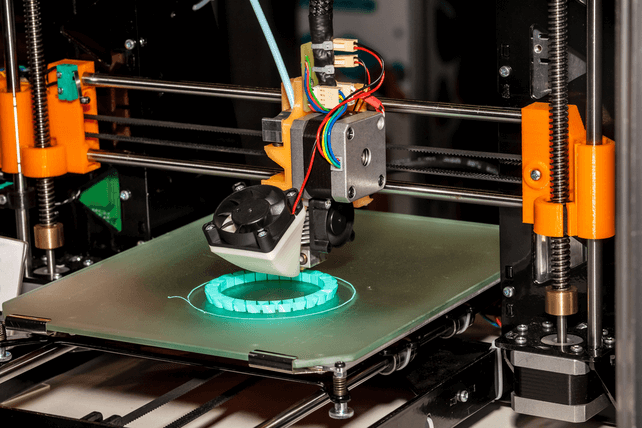

Ric Fulop, CEO of

Desktop Metal (DM), recently added 6,000 shares. The buy increased his holdings by 0.03 percent, and came to a total cost just over $19,250. This follows upon a 5,000 share buy from the prior week from the CEO, for $16,000, and a buy of 30,000 shares two weeks ago for just under $93,000. The CEO was also a buyer in March. One company director was a seller of shares last year. Overall, company insiders own about 17 percent ...

Read More About This

Desktop Metal (DM), recently added 6,000 shares. The buy increased his holdings by 0.03 percent, and came to a total cost just over $19,250. This follows upon a 5,000 share buy from the prior week from the CEO, for $16,000, and a buy of 30,000 shares two weeks ago for just under $93,000. The CEO was also a buyer in March. One company director was a seller of shares last year. Overall, company insiders own about 17 percent ...

Read More About This

Unusual Options Activity: Ring Energy (REI)

Shares of oil and gas exploration company

Ring Energy (REI) have lagged its peers, with just a 30 percent gain in the past year. One trader sees the company narrowing that gap with a move higher. That’s based on the December $5.50 calls. With 113 days until expiration, 10,126 contracts traded compared to a prior open interest of 225, for a 45-fold surge in volume on the trade. The buyer of the calls paid $0.13 to make the trade. Shares recently traded close ...

Read More About This

Ring Energy (REI) have lagged its peers, with just a 30 percent gain in the past year. One trader sees the company narrowing that gap with a move higher. That’s based on the December $5.50 calls. With 113 days until expiration, 10,126 contracts traded compared to a prior open interest of 225, for a 45-fold surge in volume on the trade. The buyer of the calls paid $0.13 to make the trade. Shares recently traded close ...

Read More About This

In Tumultuous Markets, Look for a Combination of Growth and Value

Investors don’t need to get caught in a trap between a growth stock or a value stock. In a bear market, many fast-growing companies can have their valuation knocked down until they’re a potential bargain. That gives investors the best of both worlds – a reasonable value, with some upside when the market recovers. Right now, a number of mid-sized companies fit the bill. The trick is to finding firms that are leading their industry while also still offering upside potential. One ...

Read More About This

Read More About This

Insider Trading Report: Ecolab Inc (ECL)

Bill Gates, a major owner at

Ecolab (ECL), has recently added to his holdings with three buys. The most recent was for 112,325 shares, coming to a cost of $19.6 million. The second was for 143,879 shares, valued at $25.4 million. The last was for 185,129 shares, valued at $31.8 million. Overall, the recent buys increased his stake by just under 1.5 percent. Other company insiders have been sellers, with insiders mostly being sellers over the past three years. Overall, company insiders ...

Read More About This

Ecolab (ECL), has recently added to his holdings with three buys. The most recent was for 112,325 shares, coming to a cost of $19.6 million. The second was for 143,879 shares, valued at $25.4 million. The last was for 185,129 shares, valued at $31.8 million. Overall, the recent buys increased his stake by just under 1.5 percent. Other company insiders have been sellers, with insiders mostly being sellers over the past three years. Overall, company insiders ...

Read More About This

Unusual Options Activity: Tilray Brands (TLRY)

Shares of cannabis producer

Tilray Brands (TLRY) are down 72 percent in the past year as investors have lost interest in the growing cannabis market. One trader sees the potential for a strong bounce in the months ahead. That’s based on the November $7.00 calls. With 86 days until expiration, 7,536 contracts traded compared to a prior open interest of 121, for a 62-fold rise in volume on the trade. The buyer of the calls paid $0.24. Shares recently traded around $3.50, so ...

Read More About This

Tilray Brands (TLRY) are down 72 percent in the past year as investors have lost interest in the growing cannabis market. One trader sees the potential for a strong bounce in the months ahead. That’s based on the November $7.00 calls. With 86 days until expiration, 7,536 contracts traded compared to a prior open interest of 121, for a 62-fold rise in volume on the trade. The buyer of the calls paid $0.24. Shares recently traded around $3.50, so ...

Read More About This

For Patient Investors, It’s Time to Follow the Smart Money

Every quarter, hedge funds, investment firms, and other notable individuals have to update their stock holdings with the SEC, via a 13F filing. The data can show what moves investors have made in the past few months. With the market still coming off a correction, looking at the data as a whole, investors can see where the broadest number of major investors were the most bullish. Following this smart money can tend to outperform the market over time. While 13F data may ...

Read More About This

Read More About This

Insider Trading Report: MGM Resorts International (MGM)

IAC Inc., a major owner of

MGM Resorts International (MGM) has been picking up shares with multiple buys in the past week. That includes a 279,800 share buy, for just under $10 million, and another buy for 283,700 shares, also for just under $10 million. Both buys increased the company’s holdings by nearly 1 percent. That’s the first insider buy at the company since June, when a director picked up 38,000 shares, paying just over $1.1 million. There have been some smaller insider ...

Read More About This

MGM Resorts International (MGM) has been picking up shares with multiple buys in the past week. That includes a 279,800 share buy, for just under $10 million, and another buy for 283,700 shares, also for just under $10 million. Both buys increased the company’s holdings by nearly 1 percent. That’s the first insider buy at the company since June, when a director picked up 38,000 shares, paying just over $1.1 million. There have been some smaller insider ...

Read More About This

Unusual Options Activity: Conoco Phillips (COP)

Shares of oil and gas major

Conoco Phillips (COP) have nearly doubled over the last year thanks to strong oil and gas prices. One trader sees further upside ahead for the company. That’s based on the September $120 calls. With 24 days until expiration, 12,135 contracts traded compared to a prior open interest of 218, for a 56-fold rise in volume on the trade. The buyer of the calls paid $0.61 to make the bet. Shares recently traded around $105, so they would ...

Read More About This