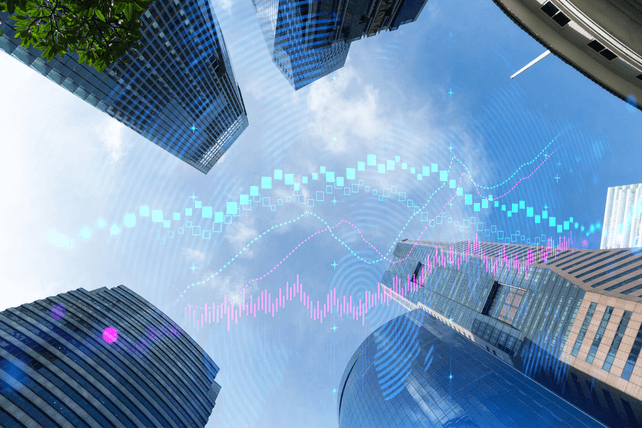

Insider Trading Report: Morgan Stanley (MS)

Stephen Luczo, a director at

Morgan Stanley (MS), recently bought 25,000 shares. The buy increased his stake by 11.8 percent, and came to a total price of just over $1.98 million. This marks the first insider buy at the company since late 2020. Over the past three years, company insiders, including both executives and directors, have generally been regular and consistent sellers of shares. Despite those sales, insiders at the investment bank own 21.8 percent of shares. The stock has pulled back in ...

Read More About This

Morgan Stanley (MS), recently bought 25,000 shares. The buy increased his stake by 11.8 percent, and came to a total price of just over $1.98 million. This marks the first insider buy at the company since late 2020. Over the past three years, company insiders, including both executives and directors, have generally been regular and consistent sellers of shares. Despite those sales, insiders at the investment bank own 21.8 percent of shares. The stock has pulled back in ...

Read More About This

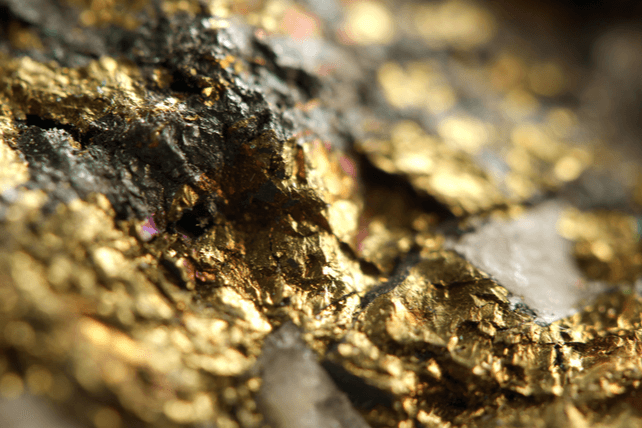

Unusual Options Activity: Agnico Eagle Mines (AEM)

Shares of gold producer

Agnico Eagles Mines (AEM) are off by over 30 percent in the past year, as gold prices have been lackluster. One trader, however, sees the possibility for a massive rally in the coming months. That’s based on the January 2024 $80 calls. With 611 days until expiration, 8,846 contracts traded hands compared to an open interest of 133, for a 67-fold increase in volume on the trade. The buyer of the calls paid $3.90. Shares last traded around $52, ...

Read More About This

Agnico Eagles Mines (AEM) are off by over 30 percent in the past year, as gold prices have been lackluster. One trader, however, sees the possibility for a massive rally in the coming months. That’s based on the January 2024 $80 calls. With 611 days until expiration, 8,846 contracts traded hands compared to an open interest of 133, for a 67-fold increase in volume on the trade. The buyer of the calls paid $3.90. Shares last traded around $52, ...

Read More About This

Why This Strong Performing Player Can Continue Higher Now

The past six months have been devastating for growth companies. From the tech space to speculative startups to everything crypto, many of the well-known growth stories of the past year have seen their gains evaporate – and then some. However, the more slow-and-steady companies have been holding up far better now. And some even play to multiple favorable market trends now, which make them likely to continue performing well in the future. That latter category is where

Berkshire Hathaway (BRK-B) has been a ...

Read More About This

Berkshire Hathaway (BRK-B) has been a ...

Read More About This

Insider Trading Report: Starbucks (SBUX)

Howard Schultz, interim CEO of

Starbucks (SBUX), recently added 137,500 shares. The buy increased his holdings by 0.6 percent, and came to a total purchase price of just under $10 million. This marks the first insider buy at the company over the past three years. Otherwise, company executives and directors alike have been regular sellers of shares of the beverage chain giant. The buy comes following the company’s latest earnings, and as Schultz takes up the CEO role for the third time. Overall, ...

Read More About This

Starbucks (SBUX), recently added 137,500 shares. The buy increased his holdings by 0.6 percent, and came to a total purchase price of just under $10 million. This marks the first insider buy at the company over the past three years. Otherwise, company executives and directors alike have been regular sellers of shares of the beverage chain giant. The buy comes following the company’s latest earnings, and as Schultz takes up the CEO role for the third time. Overall, ...

Read More About This

Unusual Options Activity: Synchrony Financial (SYF)

Shares of regional bank

Synchrony Financial (SYF) are trading near a 52-week low. One trader sees the stock moving even lower in the coming months. That’s based on the September $29 puts. With 122 days until expiration, 7,966 contracts traded compared to an open interest of 100, for an 80-fold surge in volume on the trade. The buyer of the puts paid $1.80 to make the downside bet. Shares last traded around $33.50, so the bank would need to drop more than 15 ...

Read More About This

Synchrony Financial (SYF) are trading near a 52-week low. One trader sees the stock moving even lower in the coming months. That’s based on the September $29 puts. With 122 days until expiration, 7,966 contracts traded compared to an open interest of 100, for an 80-fold surge in volume on the trade. The buyer of the puts paid $1.80 to make the downside bet. Shares last traded around $33.50, so the bank would need to drop more than 15 ...

Read More About This

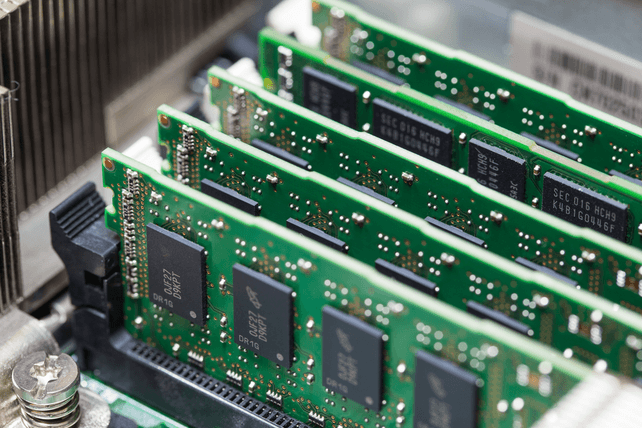

Long-Term Trends Bode Well for Tech Infrastructure Plays Now

Even with a modest slowdown in the overall economy in the first quarter of the year, and even with a potential recession if the second quarter also shows a slowdown, the world continues to improve. New technologies and networks are rolled out. New ideas hit the drawing board. And there’s still ample demand for those products to make an investment in the right tech stocks now a worthwhile one. With a number of new developments in the space, semiconductor companies are likely ...

Read More About This

Read More About This

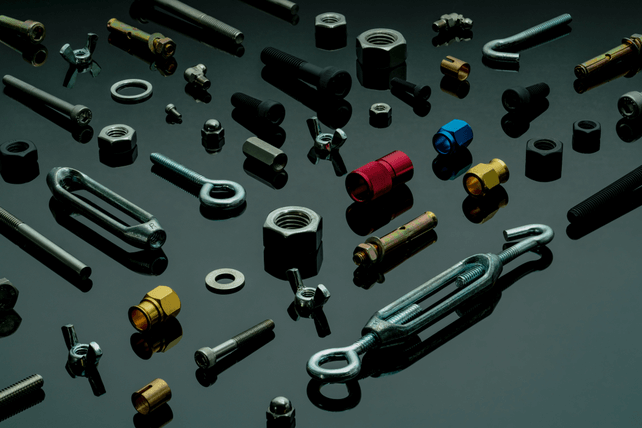

Insider Trading Report: Fastenal (FAST)

Michael Ancius, a director at

Fastenal (FAST), recently added 1,000 shares. The buy increased his stake by 3 percent, and came to a total purchase price of $51,000. This is the fourth buy from the director this year, who in total has now acquired over 2,100 shares. Going back further, sellers at the company have exceeded buyers over the past three years. Overall, insiders own about 0.2 percent of shares. The distributer of fasteners and other industrial equipment is down about 6 percent ...

Read More About This

Fastenal (FAST), recently added 1,000 shares. The buy increased his stake by 3 percent, and came to a total purchase price of $51,000. This is the fourth buy from the director this year, who in total has now acquired over 2,100 shares. Going back further, sellers at the company have exceeded buyers over the past three years. Overall, insiders own about 0.2 percent of shares. The distributer of fasteners and other industrial equipment is down about 6 percent ...

Read More About This

Unusual Options Activity: Nu Holdings (NU)

Shares of Brazilian bank

Nu Holdings (NU) have been in a steep downtrend since the company went public late last year. One trader is betting on a further decline in shares. That’s based on the June 17th $2 puts. With 32 days until expiration, 3,758 contracts traded compared to a prior interest of 112, for a 34-fold increase in volume on the trade. The buyer of the puts paid $0.18 to get into the trade. Shares of the bank recently traded around $4.00, ...

Read More About This

Nu Holdings (NU) have been in a steep downtrend since the company went public late last year. One trader is betting on a further decline in shares. That’s based on the June 17th $2 puts. With 32 days until expiration, 3,758 contracts traded compared to a prior interest of 112, for a 34-fold increase in volume on the trade. The buyer of the puts paid $0.18 to get into the trade. Shares of the bank recently traded around $4.00, ...

Read More About This