Insider Trading Report: VOXX International (VOXX)

Beat Kahli, a director and major holder of

VOXX International (VOXX), recently added 10,000 shares. The buy increased his holdings by 0.2 percent, and came to a total price of $105,000. That adds on top of other buys from this same major holder throughout the month, totaling over 140,000 shares at a cost of about $1.4 million, and further buys going back into 2021. In the same timeframe, there has been only one small insider sale. Overall, insiders own 33.3 percent of ...

Read More About This

VOXX International (VOXX), recently added 10,000 shares. The buy increased his holdings by 0.2 percent, and came to a total price of $105,000. That adds on top of other buys from this same major holder throughout the month, totaling over 140,000 shares at a cost of about $1.4 million, and further buys going back into 2021. In the same timeframe, there has been only one small insider sale. Overall, insiders own 33.3 percent of ...

Read More About This

Unusual Options Activity: Deutsche Bank (DB)

Shares of German megabank

Deutsche Bank (DB) have been trading in a range over the past year. One trader is betting that the stock’s recent attempts to move higher will continue in the next few weeks. That’s based on the March $14 calls. With 45 days until expiration, 6,870 contracts traded against an open interest of 219, for a 31-fold rise in volume. The buyer of the calls paid $0.43 to make the trade. Shares last went for about $13.20, so the stock ...

Read More About This

Deutsche Bank (DB) have been trading in a range over the past year. One trader is betting that the stock’s recent attempts to move higher will continue in the next few weeks. That’s based on the March $14 calls. With 45 days until expiration, 6,870 contracts traded against an open interest of 219, for a 31-fold rise in volume. The buyer of the calls paid $0.43 to make the trade. Shares last went for about $13.20, so the stock ...

Read More About This

Rising Inflation Fears Create Buying Opportunities for Strong Brands

With inflation running at its hottest levels since 1982, investors are rethinking how companies can cope with growing their business with such a rapid change. And many companies are starting to report that rising costs are compressing profit margins. However, if inflation does come down later in the year, profit margins for many companies can come roaring back, which could make now an attractive buying opportunity for any firm with a strong brand and customer loyalty. One such firm is paper goods ...

Read More About This

Read More About This

Insider Trading Report: William Penn Bancorporation (WMPN)

Jonathan Logan, an EVP and CFO at

William Penn Bancorporation (WMPN), recently bought 1,000 shares. The buy increased his stake by nearly 13 percent, and came to a total cost of over $12,500. The buy comes a day after the company COO bought 1,000 shares, and the company President and CEO bought 6,720 shares. All told, company insiders have been active buyers since last March, with no insider sales over the past three years. Insiders own 8.2 percent of the regional bank, ...

Read More About This

William Penn Bancorporation (WMPN), recently bought 1,000 shares. The buy increased his stake by nearly 13 percent, and came to a total cost of over $12,500. The buy comes a day after the company COO bought 1,000 shares, and the company President and CEO bought 6,720 shares. All told, company insiders have been active buyers since last March, with no insider sales over the past three years. Insiders own 8.2 percent of the regional bank, ...

Read More About This

Unusual Options Activity: Palantir Technologies (PLTR)

Shares of software intelligence company

Palantir Technologies (PLTR) have shed nearly half their value in the past few months. One trader sees the potential for a turnaround in the next month. That’s based on the February $10 calls. With 21 days until expiration, 28,052 contracts traded compared to a prior open interest of 140, for a staggering 200-fold increase in volume on the option trade. The buyer of the calls paid $3.00 to make the trade. With shares currently around $12.50, the $10 ...

Read More About This

Palantir Technologies (PLTR) have shed nearly half their value in the past few months. One trader sees the potential for a turnaround in the next month. That’s based on the February $10 calls. With 21 days until expiration, 28,052 contracts traded compared to a prior open interest of 140, for a staggering 200-fold increase in volume on the option trade. The buyer of the calls paid $3.00 to make the trade. With shares currently around $12.50, the $10 ...

Read More About This

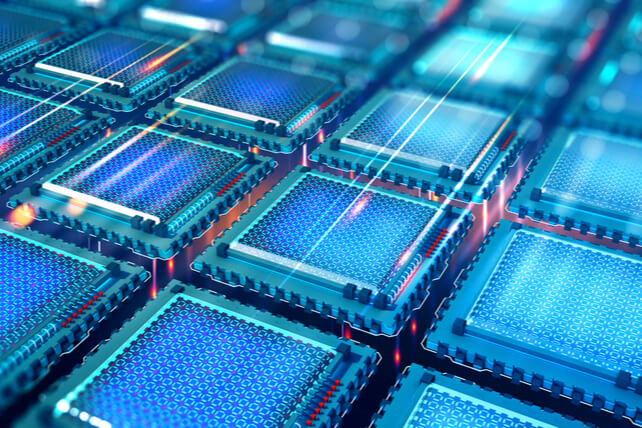

Bear Market or Not, Semiconductors Still Stand to Profit

The semiconductor shortage remains a huge setback to global manufacturing and production. However, the industry as a whole stands to profit from the trend. So it’s likely to continue growing no matter what the stock market does in the short term. Earnings season is still in its early stages, but looks strong for companies in the semiconductor space, with strong sales, ongoing demand, and improving profit margins. One early winner from earnings season is

Texas Instruments (TXN). The semiconductor manufacturer beat analyst ...

Read More About This

Texas Instruments (TXN). The semiconductor manufacturer beat analyst ...

Read More About This

Insider Trading Report: EverQuote (EVER)

David Blundin, a director and major owner of

EverQuote (EVER) recently added 55,239 shares. The buy increased his holdings by just over 1.5 percent, and came to a total price of $812,000. This is the fourth time the director has been a buyer of shares since the start of 2022, with additional purchases of over 150,000 shares totaling nearly $2 million. Going further back, insiders have been more likely to be sellers of shares. Overall, insiders at the company own nearly 24 ...

Read More About This

EverQuote (EVER) recently added 55,239 shares. The buy increased his holdings by just over 1.5 percent, and came to a total price of $812,000. This is the fourth time the director has been a buyer of shares since the start of 2022, with additional purchases of over 150,000 shares totaling nearly $2 million. Going further back, insiders have been more likely to be sellers of shares. Overall, insiders at the company own nearly 24 ...

Read More About This

Unusual Options Activity: Home Depot (HD)

Shares of home improvement retail chain

Home Depot (HD) have slid sharply with the overall market in recent sessions. One trader is willing to bet that shares are ready to move higher. That’s based on the March $390 calls. With 49 days until expiration, 13,811 contracts traded compared to a prior open interest of 386, for a 36-fold rise in volume. The buyer of the calls paid $4.75 to make the trade. The stock recently traded closer to $360, so it would take ...

Read More About This

Home Depot (HD) have slid sharply with the overall market in recent sessions. One trader is willing to bet that shares are ready to move higher. That’s based on the March $390 calls. With 49 days until expiration, 13,811 contracts traded compared to a prior open interest of 386, for a 36-fold rise in volume. The buyer of the calls paid $4.75 to make the trade. The stock recently traded closer to $360, so it would take ...

Read More About This