Buy the Overreaction to Poor Earnings

This earnings season came at a time of market weakness. That set the tone for how most stocks have fared. Companies that have beaten earnings haven’t had much of a move higher on the news. However, those that missed on earnings have been heavily punished. Fortunately, the earnings move could mean investors have a longer-term opportunity. That’s because a company that’s been hard hit from earnings may start to trend higher in the weeks ahead. Despite good earnings relative to the impact ...

Read More

Read More

Insider Activity Report: Cincinnati Financial (CINF)

Dirk Debbnik, a director at Cincinnati Financial (CINF), recently bought 1,000 shares. The buy increased his stake by about 2 percent, and came to a total cost of $98,781. That buy comes about six weeks after another director also bought 1,000 shares. Company insiders have generally been buyers this year, with just one sale. Over the past two years, a similar number of consistent director buys far outpacing sales has been the case. Overall, company insiders own about 1.6 percent of ...

Read More

Read More

Unusual Options Activity: Robinhood (HOOD)

Internet brokerage firm Robinhood (HOOD) dropped 15 percent on Wednesday following weak earnings. One trader is betting on shares to rebound from its quarterly report. That’s based on the February 2024 $8 calls. With 98 days until expiration, 4,576 contracts traded compared to a prior open interest of 124, for a 37-fold rise in volume on the trade. The buyer of the calls paid $1.08 to make the bullish bet. Shares recently traded for about $8.35, making this a slightly in-the-money trade ...

Read More

Read More

Invest With Companies Flipping to Profitability

Many companies go public before they’re able to fully earn a profit. Selling shares to the general population spreads around the risk, and allows a company to raise capital to fund operations. Once a company goes public, moving to profitability is key. The past few years saw a surge of early-stage companies going public, but many failed to grow and become profitable. Of those that have moved to profitability, chances are shares can move higher in the years ahead. One such company ...

Read More

Read More

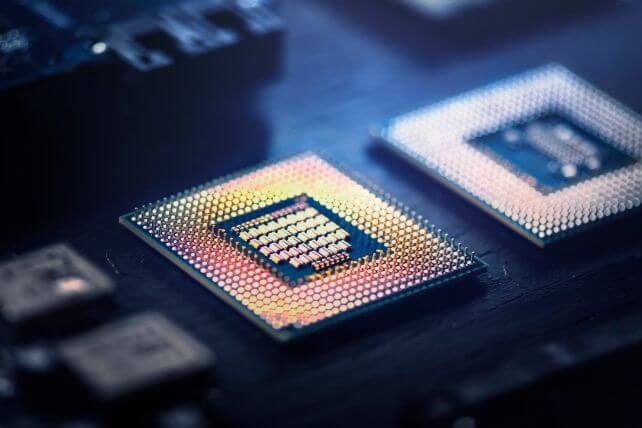

Insider Activity Report: Intel (INTC)

Patrick Gelsinger, CEO at Intel (INTC), recently added 6,775 shares. The buy increased his position by about 1 percent, and came to a total cost of $249,333. This is the first insider buy at Intel since August, when Gelsinger bought 3,850 shares. There have been some small insider buys and sells in the past few months, but overall, insiders have been big buyers of shares over the past two years. All told, Intel insiders own about 0.1 percent of shares. The chipmaker ...

Read More

Read More

Unusual Options Activity: WestRock Company (WRK)

Packaging and container firm WestRock Company (WRK) is up 7 percent over the past year, about half as much as the overall stock market. One trader sees shares trending higher in the coming weeks. That’s based on the December $37.50 calls. With 35 days until expiration, 14,107 contracts traded compared to a prior open interest of 249, for a 57-fold rise in volume on the trade. The buyer of the calls paid $1.95 to make the bullish bet. WestRock recently traded right ...

Read More

Read More

Buy Companies the Market Dislikes Ahead of a Year-End Rally

Investors have plenty of ways to play a seasonal rally for stocks. The past few weeks have seen stocks get hit hard to the downside, then surge higher. Highly volatile stocks have led the way in both directions. Going into the end of the year, companies that are disliked tend to perform best. That may be because they’ve gotten more oversold than other stocks, or are more prone to being squeezed higher. Either way, investors can buy disliked stocks for a ...

Read More

Read More

Insider Activity Report: Delta Air Lines (DAL)

David Taylor, a director at Delta Air Lines (DAL), recently bought 20,000 shares in two 10,000 share buys. The first buy cost just under $331,000, and the second buy came to $307,500. The director was previously a buyer back in April, the last time shares also traded in the low $30 range before moving higher over the summer. Over the same time, several company executives were sellers when shares traded in the high-$30 to low-$40 range. Overall, Delta insiders own 0.3 ...

Read More

Read More