This Diversified Play on the Economy Likely Made the Right Moves this Quarter

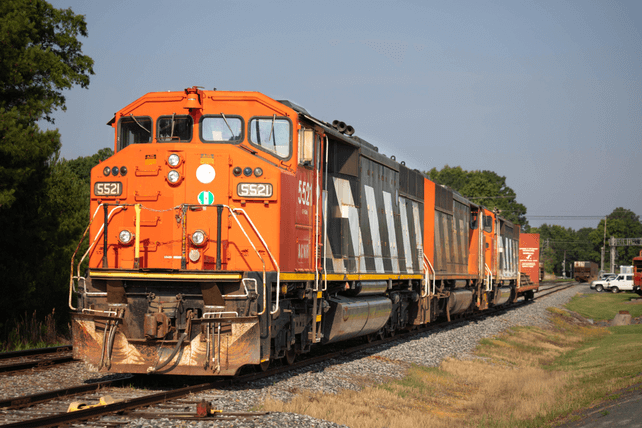

Every company navigates earnings season a bit differently, no matter what sector they’re in. However, few companies report on the weekend. One exception?

Berkshire Hathaway (BRK-B). The company reports this Saturday. A likely economic rebound in many of the company’s fully-owned subsidiaries, appreciating stock portfolio, and share buybacks point to some big profits ahead. Going forward, the mix of improving earnings and reduced share could should continue to drive shares higher. Already, estimates are for a 32 percent rise in operating earnings, thanks ...

Read More About This

Berkshire Hathaway (BRK-B). The company reports this Saturday. A likely economic rebound in many of the company’s fully-owned subsidiaries, appreciating stock portfolio, and share buybacks point to some big profits ahead. Going forward, the mix of improving earnings and reduced share could should continue to drive shares higher. Already, estimates are for a 32 percent rise in operating earnings, thanks ...

Read More About This

Insider Trading Report: Beacon Roofing Supply (BECN)

CD&R Investment Associates IX, a major owner of

Beacon Roofing Supply (BECN), recently added 116,945 shares to their holdings. The buy increased the fund’s stake by over 0.8 percent, and came to a total purchase price of $6 million. This marks the first insider buys since August, when the company CEO and CFO bought shares, with the CFO buying nearly $100,000 in shares and the company CEO nearly $245,000. Going farther back, insiders were more likely to be sellers. Company insiders own just ...

Read More About This

Beacon Roofing Supply (BECN), recently added 116,945 shares to their holdings. The buy increased the fund’s stake by over 0.8 percent, and came to a total purchase price of $6 million. This marks the first insider buys since August, when the company CEO and CFO bought shares, with the CFO buying nearly $100,000 in shares and the company CEO nearly $245,000. Going farther back, insiders were more likely to be sellers. Company insiders own just ...

Read More About This

Unusual Options Activity: BlackBerry (BB)

Shares of wireless communications company

BlackBerry (BB) have been trading relatively flat since a big surge higher at the start of the year and a smaller rally higher in May. One trader sees the possibility for another jump higher in shares in the coming weeks. That’s based on the November 26 $17 calls. Expiring in 23 days, over 4,465 contracts traded against a prior open interest of 101, for a 23-fold jump in volume. The buyer of the call paid $0.21 to ...

Read More About This

BlackBerry (BB) have been trading relatively flat since a big surge higher at the start of the year and a smaller rally higher in May. One trader sees the possibility for another jump higher in shares in the coming weeks. That’s based on the November 26 $17 calls. Expiring in 23 days, over 4,465 contracts traded against a prior open interest of 101, for a 23-fold jump in volume. The buyer of the call paid $0.21 to ...

Read More About This

This Formerly Bankrupt Company May Hint at the Future of Travel

Last year, retail traders piled into shares of

Hertz Global (HTZZ) as the company was still in bankruptcy. With the company largely in limbo due to the pandemic’s uncertainty regarding business and leisure travel, the notion of investors buying in seemed ridiculous. But those investors are having the last laugh. They pushed the share price higher, allowed the company to issue more shares and pay down debt, and now the world is facing a shortage of cars rather than a surplus. Last week, ...

Read More About This

Hertz Global (HTZZ) as the company was still in bankruptcy. With the company largely in limbo due to the pandemic’s uncertainty regarding business and leisure travel, the notion of investors buying in seemed ridiculous. But those investors are having the last laugh. They pushed the share price higher, allowed the company to issue more shares and pay down debt, and now the world is facing a shortage of cars rather than a surplus. Last week, ...

Read More About This

Insider Trading Report: Cricut Inc (CRCT)

The Abdiel Qualified Master Fund, a major owner of

Cricut Inc (CRCT), recently added 42,558 shares to its holdings. The buy increased the fund’s ownership by 0.23 percent, and came to a total price of just over $1.1 million. The fund has been a repeat buyer over the past few months, picking up nearly 900,000 shares since the start of September. A number of company insiders have been sellers prior to these repeat buys. Overall, company insiders own nearly 15 percent of ...

Read More About This

Cricut Inc (CRCT), recently added 42,558 shares to its holdings. The buy increased the fund’s ownership by 0.23 percent, and came to a total price of just over $1.1 million. The fund has been a repeat buyer over the past few months, picking up nearly 900,000 shares since the start of September. A number of company insiders have been sellers prior to these repeat buys. Overall, company insiders own nearly 15 percent of ...

Read More About This

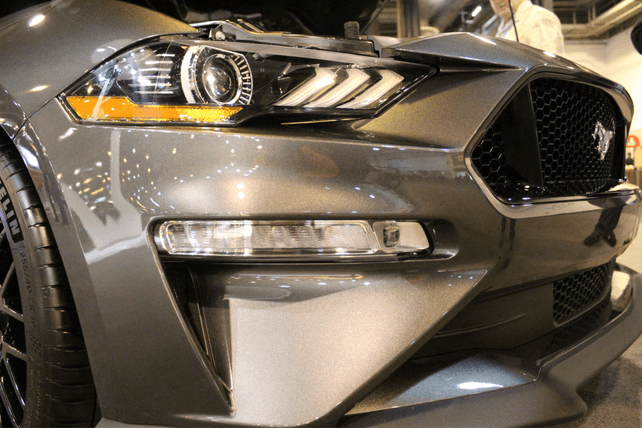

Unusual Options Activity: Ford Motors (F)

Shares of automaker

Ford Motors (F) have more than doubled in the past year. One trader sees shares heading even higher in the months ahead. That’s based on the March $28 calls. With 136 days until expiration, over 12,695 contracts traded against a prior open interest of 137, for a 93-fold jump in volume. The buyer of the calls paid $0.14 to make the trade. With shares trading around $17, they’d need to surge another 64 percent for the option to move in-the-money ...

Read More About This

Ford Motors (F) have more than doubled in the past year. One trader sees shares heading even higher in the months ahead. That’s based on the March $28 calls. With 136 days until expiration, over 12,695 contracts traded against a prior open interest of 137, for a 93-fold jump in volume. The buyer of the calls paid $0.14 to make the trade. With shares trading around $17, they’d need to surge another 64 percent for the option to move in-the-money ...

Read More About This

This Retailer’s Business Model Isn’t Feeling the Sting of Supply Shortages

A number of companies have been warning this earnings season about potential supply chain shortages. While many retailers may see some partially bare shelves, those that have embraced a different business model are faring just fine. One such company is

Overstock (OSTK). The company is an online-retailer. Its business model involves acquiring and selling inventory that other retailers have already tried to sell, although today it also carries new items. While many were expecting retail to struggle, the company’s most recent financials show ...

Read More About This

Overstock (OSTK). The company is an online-retailer. Its business model involves acquiring and selling inventory that other retailers have already tried to sell, although today it also carries new items. While many were expecting retail to struggle, the company’s most recent financials show ...

Read More About This

Insider Trading Report: Bank of the James Financial Corp (BOTJ)

Julie Doyle, a director at

Bank of the James Corp (BOTJ) recently picked up 1,000 shares. The buy increased her stake by over 8 percent, and came to a total purchase price of $16,000. A number of other directors and a company Treasurer also bought shares, albeit in the few hundred share range. Over the past three years, insiders have been exclusively buyers of shares on a regular basis. Overall, company insiders own just over 13 percent of the regional bank. Shares of ...

Read More About This

Bank of the James Corp (BOTJ) recently picked up 1,000 shares. The buy increased her stake by over 8 percent, and came to a total purchase price of $16,000. A number of other directors and a company Treasurer also bought shares, albeit in the few hundred share range. Over the past three years, insiders have been exclusively buyers of shares on a regular basis. Overall, company insiders own just over 13 percent of the regional bank. Shares of ...

Read More About This