Unusual Options Activity: Gilead Sciences (GILD)

Shares of biotech firm

Gilead Sciences (GILD) have been trending slightly higher in the past year. One trader sees the opportunity for shares to move higher in the months ahead. That’s based on the June $75 calls. With 268 days until expiration, over 30,430 contacts traded against ta prior open interest of 1,121, for a 29-fold jump in volume. The buyer of the calls paid $4.80 to make the trade. Shares of the biotech recently traded around $71, so they would need to ...

Read More About This

Gilead Sciences (GILD) have been trending slightly higher in the past year. One trader sees the opportunity for shares to move higher in the months ahead. That’s based on the June $75 calls. With 268 days until expiration, over 30,430 contacts traded against ta prior open interest of 1,121, for a 29-fold jump in volume. The buyer of the calls paid $4.80 to make the trade. Shares of the biotech recently traded around $71, so they would need to ...

Read More About This

Is the Most Important Stock of Earnings Season a Buy Now?

Investors have come to expect big tech stocks to drive the market higher. But for a sign as to how the real economy is performing, there are other sectors to look at. Energy is one player, and gradually rising prices in the space suggest the economic recovery, while uneven, is continuing. Another area is in shipping and logistics. Many headline stories about supply chain issues overlook the fact that labor shortages in shipping has been a big driver of prices. One company ...

Read More About This

Read More About This

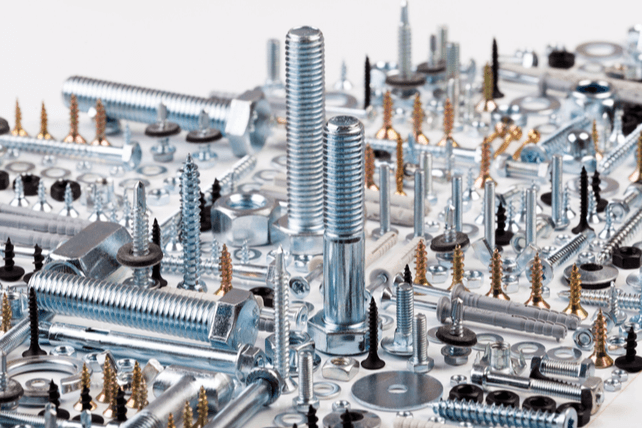

Insider Trading Report: Fastenal (FAST)

Sam Hsu, a director at

Fastenal (FAST), recently bought 1,000 shares. The buy increased his stake by 50 percent, and came to a total price of just under $53,000. The buy came just a few days after another director bought 265 shares, paying just over $14,000 to make the buy. Overall, company insiders have been active as both buyers and sellers, although insider sales have far exceeded buys over the past 3 years, even as the stock has trended higher. Shares of ...

Read More About This

Fastenal (FAST), recently bought 1,000 shares. The buy increased his stake by 50 percent, and came to a total price of just under $53,000. The buy came just a few days after another director bought 265 shares, paying just over $14,000 to make the buy. Overall, company insiders have been active as both buyers and sellers, although insider sales have far exceeded buys over the past 3 years, even as the stock has trended higher. Shares of ...

Read More About This

Unusual Options Activity: Roku (ROKU)

Shares of TV streaming platform

Roku (ROKU) have been trending down since July. One trader sees the possibility for a rebound in the months ahead. That’s based on the December $325 calls. With 87 days until expiration, over 5,070 contracts traded, a 34-fold increase in volume compared to the prior open interest of 150. The buyer of the calls paid $30.08 to make the trade. Shares currently trade around $324, making this an at-the-money trade. Options should rise dollar-for-dollar with shares, less any ...

Read More About This

Roku (ROKU) have been trending down since July. One trader sees the possibility for a rebound in the months ahead. That’s based on the December $325 calls. With 87 days until expiration, over 5,070 contracts traded, a 34-fold increase in volume compared to the prior open interest of 150. The buyer of the calls paid $30.08 to make the trade. Shares currently trade around $324, making this an at-the-money trade. Options should rise dollar-for-dollar with shares, less any ...

Read More About This

This Commodity’s Rally Is Likely to Continue

The past year has seen a number of commodities rise, and then sometimes fall. The list includes lumber, which at one point was the highest-performing commodity of the year before dropping. The past few weeks have seen a major increase in interest in uranium. While some see the trend as the result of retail traders, hedge funds and family offices are also gaining exposure to the commodity to take advantage of higher prices as well. Some of that demand has gone into ...

Read More About This

Read More About This

Insider Trading Report: JOANN Inc (JOAN)

Ann Aber, senior vice president and general counsel at

JOANN Inc (JOAN) recently picked up 1,000 shares. The buy increased her holdings by 66 percent, and came to a total price of just over $11,000. Her buy was made a day after a 9,500 share buy from the company’s SVP and Chief of Merchandise, who paid just over $99,000. The company’s Chief Customer Officer picked up 2,500 shares on the same day, paying just under $26,000. This marks the first cluster of insider ...

Read More About This

JOANN Inc (JOAN) recently picked up 1,000 shares. The buy increased her holdings by 66 percent, and came to a total price of just over $11,000. Her buy was made a day after a 9,500 share buy from the company’s SVP and Chief of Merchandise, who paid just over $99,000. The company’s Chief Customer Officer picked up 2,500 shares on the same day, paying just under $26,000. This marks the first cluster of insider ...

Read More About This

Unusual Options Activity: Robinhood (HOOD)

Shares of stock brokerage firm

Robinhood (HOOD) have been declining since their IPO. One trader sees the decline continuing for the next few months. That’s based on the January $31 puts. With 123 days until expiration, over 1,500 contracts traded against a prior open interest of 114, for a 13-fold rise in volume. The buyer of the puts paid $2.80 to make the buy. Shares last traded around $42, so they would need to drop about $9, or more than 25 percent for ...

Read More About This

Robinhood (HOOD) have been declining since their IPO. One trader sees the decline continuing for the next few months. That’s based on the January $31 puts. With 123 days until expiration, over 1,500 contracts traded against a prior open interest of 114, for a 13-fold rise in volume. The buyer of the puts paid $2.80 to make the buy. Shares last traded around $42, so they would need to drop about $9, or more than 25 percent for ...

Read More About This

Subscription Revenue Makes for a Successful Long-Term Investment

Wall Street loves a company that can create a subscription-based revenue model. Ensuring that customers come back monthly or annually make it possible for companies to better plan their future with some consistency. While a company with such a model might see lower growth, the consistency of growth tends to be appreciated by investors and analysts alike. Many companies, particularly in the tech space, have been embracing this model. One such company is

Cisco (CSCO). The builder of the original Internet with switches ...

Read More About This

Cisco (CSCO). The builder of the original Internet with switches ...

Read More About This