This Company Will Keep Delivering Profits

The market is starting to show some mixed signals. The effects of above-average inflation over the past few years has hit a number of sectors hard. Investors are now learning that fast food may still be fast, but with soaring food prices it may not be cheap. However, there remain some opportunities in the restaurant industry. Particularly for companies that can keep costs down, consumers happy, and already have a reputation for beating the market. Pizza giant Domino’s (DPZ) just beat ...

Read More

Read More

Insider Activity Report: Banc of California (BANC)

Jared Wolff, President and CEO of Banc of California (BANC), recently added 7,130 shares. The buy increased his position by 2%, and came to a total cost of $99,677. The buy comes a month after a company director bought 7,500 shares, paying just over $108,500. And another company director was a buyer in February. The last insider sale occurred in late January at a slightly higher price for shares. Overall, Banc of California insiders own 1.1% of shares. The regional bank is ...

Read More

Read More

Unusual Options Activity: PACCAR (PCAR)

Commercial truck designer and manufacturer PACCAR (PCAR) is up nearly 50% over the past year. One trader sees shares pulling back in the coming weeks. That’s based on the June $100 puts. With 51 days until expiration, 10,327 contracts traded compared to a prior open interest of 198, for a 52-fold rise in volume on the trade. The buyer of the puts paid $0.96 to make the bearish bet. PACCAR shares recently traded for about $114, so the stock would need to ...

Read More

Read More

Brand Power Still Matters as Inflation Remains Sticky

While inflation is nowhere near its highs from the past few years, it’s still stuck at a higher level. That could weigh on company profitability, particularly for companies that can’t pass off higher prices to customers. However, companies with strong brands and low-priced items can typically raise their prices above and beyond inflation. That means that even as prices rise, they can continue to earn a solid return. These companies may be worth a closer look as inflation stays high. One such ...

Read More

Read More

Insider Activity Report: MSCI (MSCI)

Henry Fernandez, CEO at MSCI (MSCI), recently bought 13,000 shares. The buy increased his holdings by 6%, and came to a total cost of $6.06 million. He was joined by the company COO, who bought 7,500 shares for about $3.4 million on the same day. This marks a shift from last year, when company insiders were sellers of shares, including the company CFO. The sales mostly occurred at higher prices from where MSCI trades today. Overall, MSCI insiders own 3.2% ...

Read More

Read More

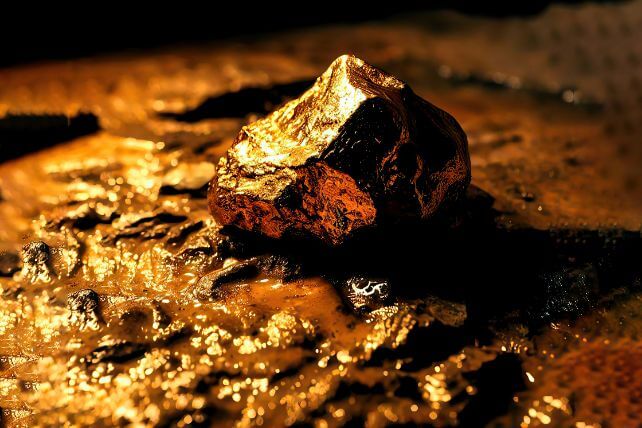

Unusual Options Activity: Barrick Gold (GOLD)

Gold prices have been trending higher this year, and so have gold miners. One trader is betting that major gold miner Barrick Gold (GOLD) will see massive gains in the months ahead. That’s based on the November $25 calls. With 199 days until expiration, 3,082 contracts traded compared to a prior open interest of 175, for an 18-fold rise in volume on the trade. The buyer of the calls paid $0.25 to make the bullish bet. Barrick shares recently traded for about ...

Read More

Read More

Buy the Short-Term Bumps in Booming Industries

Investors can make great returns with the right blue-chip stocks, provided they’re bought at the right time. Many companies go in and out of favor with the market for various reasons, and earnings season can lead to quick drops. However, for sectors that have bullish longer-term trends behind them, a drop following earnings can be a great investment opportunity. It can allow investors to buy in and get a reasonable price on a company likely to outperform for years. Right now, the ...

Read More

Read More

Insider Activity Report: Regions Financial (RF)

William Rhodes, a director at Regions Financial (RF), just picked up 50,000 shares. The buy increased his holdings by over 1,000%, and came to a total cost of $968,500. This marks the first insider buy since last May, when another director bought 11,926 shares at a cost of $200,134. In the past year, there have been two insider sales from company executives, with the largest sale coming to a cost of just under $500,000. Overall, Regions insiders own 0.3% of ...

Read More

Read More