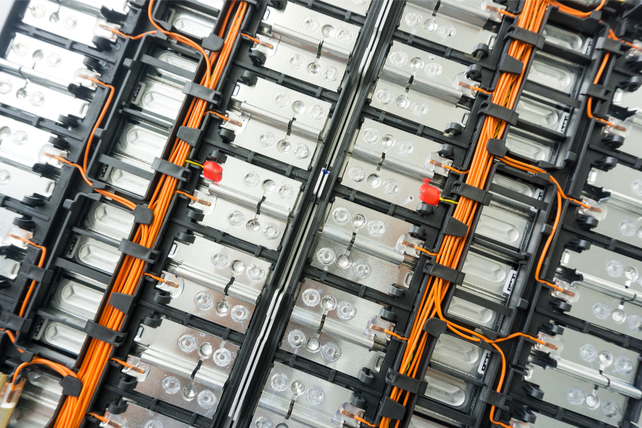

Insider Trading Report: QuantumScape (QS)

Volkswagen Group, a major holder ofQuantumScape (QS) made an additional 15.2 million share buy recently. That increased the company’s holdings by nearly 30 percent. The purchase price came to just over $100 million.

The share buy occurred as the lithium-metal battery company met a technical milestone. This purchase by Volkswagen is the first insider transaction at the company. In total, all insiders at the company still retain over 30 percent of shares.

Shares of QuantumScape went public last August via a special ...

Read More About This

Read More About This

Insider Trading Report: Oracle (ORCL)

Alison Fairhead, a director atOracle (ORCL), recently bought 10,242 shares. The buy came to just under $690,000 and increased her holdings by 173 percent.

Insiders are typically overwhelmingly sellers at the company, as to be expected from a big cap tech company that generously issues options to executives. Over the past three years, the only other insider buys occurred in March 2020, right at the bottom of the pandemic selloff.

Thanks to the large holdings by billionaire Larry Ellison, insiders still own ...

Read More About This

Read More About This

Insider Trading Report: VIZIO Holding Corp (VZIO)

Julia Gouw, a director atVIZIO Holding Corp (VZIO) recently made a 35,000 share buy to start a new stake in the company. The purchase price came to $735,000.

This marks the first insider buy since the company’s IPO in March. A number of other insiders, from major holders to the company COO to a director, have been selling off their stakes, even as shares have pushed higher.

Shares are up about 14 percent since their IPO price. The consumer electronics goods company ...

Read More About This

Read More About This

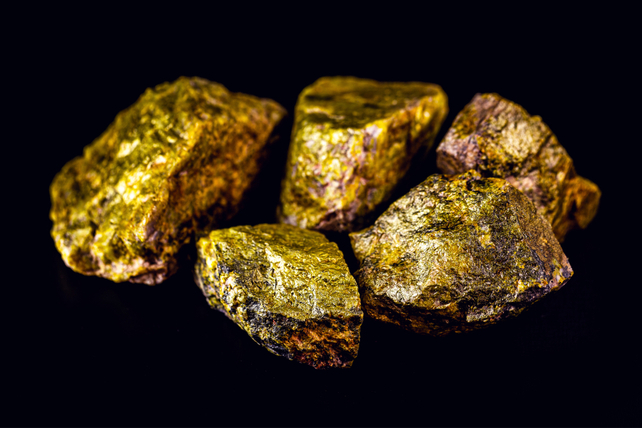

Insider Trading Report: Gold Resource Corp (GORO)

Ronald Little, a director atGold Resource Corp (GORO), recently bought 20,000 shares. The buy doubled his holdings, and came to a total cost of just over $52,000.

Over the past few years, buyers have far outnumbered sellers. Company insiders were bigger sellers of shares back in 2018, however, at a time when shares were priced twice as high as they are today. Overall, insiders own just over 3 percent of shares.

Gold Resources explores, develops, and produces gold and silver, among other ...

Read More About This

Read More About This

Insider Trading Report: Designer Brands Inc (DBI)

Joseph Schottenstein, a director atDesigner Brands Inc (DBI) recently picked up 273,099 shares. The buy increased his stake by nearly 25 percent, and came to a total purchase price of $3.8 million.

He was joined by Executive Chairman Jay Schottenstein, who made a 902,600 share buy. That increased his stake by nearly 45 percent, and came to a total cost of $12.6 million. Insiders at the firm now own nearly 8 percent of shares.

Shares of the company, which owns a design ...

Read More About This

Read More About This

Insider Trading Report: PennyMac Financial (PFSI)

MFN Partners, a fund with a director’s seat atPennyMac Financial (PFSI), recently added to their stake with a 344,322 share buy. The purchase came to just under $21.5 million, and increased their holdings by nearly 40 percent.

Other directors have been buyers this year as well, however, there have also been some insider sales. Over the past three years, insider sales have topped insider buys, despite the recent switch. Overall, insiders own over 44 percent of shares.

The mortgage servicing company has ...

Read More About This

Read More About This

Insider Trading Report: Veritiv Corp (VRTV)

Stephen Macadam, a director atVeritiv Corp (VRTV), recently bought 5,000 shares. The buy increased his stake by over 37 percent, and came to a total purchase price of just under $198,000.

This marks the first insider transaction of 2021. Company C-suite executives were generally buyers during last year’s market selloff, although a major holder made a large sale in late November. Overall, company insiders own about 3 percent of the company.

Shares are up nearly 300 percent in the past year, as ...

Read More About This

Read More About This

Insider Trading Report: Perrigo Co (PRGO)

Geoffrey Parker, a director atPerrigo Co (PRGO), recently picked up 2,500 shares. The buy increased his stake by nearly 18 percent, and came to a total purchase price of just over $103,000.

This marks the first insider buy at the company since January. Insiders have been active on both the buy and sell side, with an insider sale earlier in the month. Overall, in the past three years, buyers have outnumbered sellers.

Shares of the generic drug manufacturer have been in a ...

Read More About This

Read More About This